If you’ve ever wondered, “What is Wrapped Bitcoin?”, you’re not the only one. Wrapped Bitcoin (WBTC) is an ERC-20 token on the Ethereum blockchain that represents Bitcoin (BTC) at a 1:1 ratio. It enables Bitcoin holders to use their BTC on the Ethereum network opening up a world of decentralised finance (DeFi) applications and other Ethereum-based services to Bitcoin users that are not normally available on a Bitcoin exchange.

Table of Contents

- Understanding WBTC and its Purpose

- The Mechanics of WBTC: How Does it Work?

- The Need for WBTC

- Benefits of WBTC

- Creating WBTC Tokens: Role of Custodians and Merchants

- Buying Wrapped Bitcoin

- WBTC in Decentralised Finance

- Utilising WBTC in Ethereum Based Dapps

- WBTC Transactions on the Ethereum Network

- Exploring Other Wrapped Tokens

- The Role of the WBTC DAO in the Wrapped Bitcoin Ecosystem

- Future of Wrapped Bitcoin (WBTC)

Understanding WBTC and its Purpose

Picture having a beautiful painting, but it’s locked away in a vault, and you can’t display it in a gallery. That’s what it’s like for Bitcoin holders who want to participate in the DeFi ecosystem on Ethereum. Wrapped Bitcoin is the solution to this problem, acting as a “frame” that allows your Bitcoin to be utilised on the Ethereum network.

In simple terms, Wrapped Bitcoin is like a digital wrapper for your Bitcoin, converting it into an Ethereum-based token. This wrapped token represents your Bitcoin at a 1:1 ratio, allowing you to use your Bitcoin seamlessly within DeFi applications, decentralised exchanges (DEXs), and more. The primary purpose of Wrapped Bitcoin is to bridge the gap between the two largest cryptocurrency ecosystems, unlocking the full potential of Bitcoin in DeFi.

The Mechanics of WBTC: How Does it Work?

Wrapped Bitcoin operates similarly to a postal service. When you want to send a letter, you put it in an envelope, stick a stamp on it, and send it through the postal system. In the case of WBTC, your Bitcoin is “wrapped” in an Ethereum-based token (the envelope) and sent through the Ethereum blockchain (the postal system).

To create WBTC tokens, a process called “wrapping” is used. The process involves locking an equivalent amount of Bitcoin on the Bitcoin blockchain and minting an equal number of tokens on Ethereum. The wrapping process is facilitated by a consortium called the WBTC DAO, which consists of custodians, merchants, and users. This system allows Bitcoin holders to integrate their assets into the DeFi ecosystem seamlessly.

The Need for WBTC

While Bitcoin is the undisputed king of cryptocurrencies, it has certain limitations when compared to Ethereum. The Bitcoin network cannot directly interact with Ethereum’s smart contracts or its DeFi ecosystem, restricting Bitcoin users from fully utilising the potential of DeFi. Wrapped Bitcoin overcomes these limitations by allowing Bitcoin users to access Ethereum’s applications and services.

Benefits of WBTC

Wrapped Bitcoin offers several benefits to its users, including increased liquidity, access to DeFi platforms, and the ability to trade and invest in a token that represents Bitcoin on decentralised exchanges. Additionally, WBTC enables Bitcoin holders to utilise their assets in various Ethereum-based DeFi protocols, such as lending, borrowing, and staking platforms.

Creating WBTC Tokens: Role of Custodians and Merchants

The creation of WBTC tokens involves the collaboration of custodians and merchants. Think of custodians as the bank vaults, holding the underlying Bitcoin reserves, ensuring that there is always a 1:1 ratio between the number of wrapped tokens and the locked Bitcoin. Merchants, on the other hand, are like friendly bank tellers who facilitate the minting and burning of tokens on the Ethereum blockchain and provide an interface for users to convert their BTC to WBTC or vice versa.

Buying Wrapped Bitcoin (WBTC)

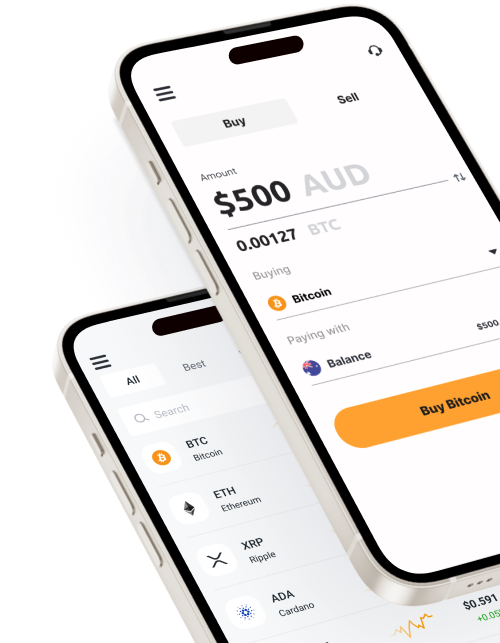

Acquiring Wrapped Bitcoin is a straightforward process, similar to converting one currency to another. You can convert your BTC to WBTC on various decentralised exchanges (DEXs) or centralised exchanges (CEXs). Alternatively, you can purchase WBTC directly from a WBTC merchant using your Bitcoin. This process is simple and allows you to quickly access WBTC tokens for use on the Ethereum network.

WBTC in Decentralised Finance (DeFi)

With Wrapped Bitcoin, Bitcoin holders can join the rapidly growing DeFi ecosystem on Ethereum. They can use WBTC to lend, borrow, stake, or provide liquidity on DeFi platforms, earning passive income and leveraging their Bitcoin holdings in new ways. Furthermore, WBTC can be traded on decentralised exchanges, offering Bitcoin holders the opportunity to diversify their portfolio and access new investment opportunities within the Ethereum ecosystem. This allows users to capitalise on the growth and innovation happening in the DeFi space while retaining exposure to Bitcoin’s value.

Utilising WBTC in Ethereum-based dApps

Wrapped Bitcoin tokens can be used in various Ethereum-based decentralised applications (dApps), enabling Bitcoin holders to take full advantage of the functionalities offered by these platforms. This seamless integration of WBTC into Ethereum’s DeFi ecosystem allows users to access a wide range of services and applications that were previously inaccessible to them due to the limitations of the Bitcoin network.

WBTC Transactions on the Ethereum Network

By converting BTC to WBTC, users can perform transactions on Ethereum, utilising its faster transaction speeds and lower fees compared to the Bitcoin network. This enables Bitcoin users to access Ethereum’s array of DeFi applications and services more efficiently, making WBTC an attractive alternative for those looking to optimise their use of digital assets.

Exploring Other Wrapped Tokens

Besides Wrapped Bitcoin, there are other wrapped tokens available that help bridge the gap between various blockchain networks. These wrapped tokens enable users to access DeFi applications and services from different blockchain ecosystems, thereby increasing interoperability and expanding the potential of decentralised finance. As the DeFi landscape grows, the demand for wrapped tokens is expected to rise, leading to the development of more wrapping solutions for various cryptocurrencies.

The Role of the WBTC DAO in the Wrapped Bitcoin Ecosystem

The WBTC DAO plays a significant role in maintaining the trust, transparency, and security of the Wrapped Bitcoin ecosystem. As a decentralised autonomous organisation, the WBTC DAO oversees the wrapping and unwrapping of Bitcoin, ensuring that there is always a 1:1 ratio between the number of WBTC tokens and the locked Bitcoin. By providing a governance framework for the Wrapped Bitcoin ecosystem, the WBTC DAO helps maintain the integrity of the system and ensures that the interests of WBTC users are protected.

Future of Wrapped Bitcoin

The future of Wrapped Bitcoin looks promising. As the DeFi ecosystem continues to expand and evolve, demand for the wrapped token is likely to grow. Additionally, WBTC could serve as a blueprint for wrapping other crypto assets, further bridging the gap between different blockchain networks and enhancing interoperability.