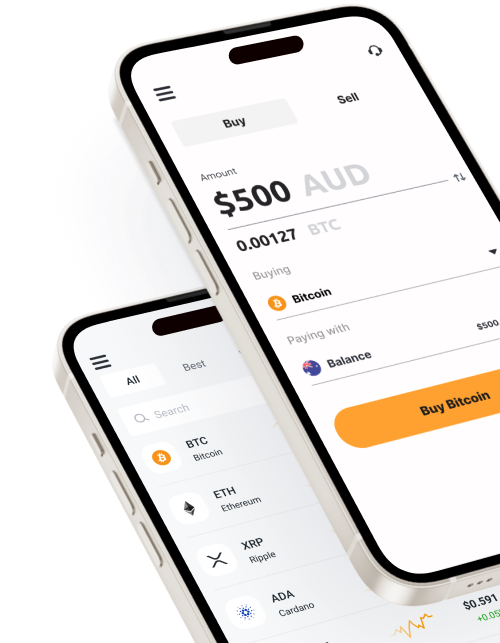

If you’ve been trading cryptocurrency recently, it’s time to start thinking about how it will affect your tax return. This is even more important now that the Australian Taxation Office (ATO) has declared that they will specifically target crypto traders.

Are Cryptocurrencies Personal Assets?

The longer you hold some cryptocurrency, the less likely that it will be a personal asset. Therefore, you will have to wait until the time of disposal to accurately pin down whether your crypto was a personal asset or not.

Your cryptocurrency will definitely not be a personal asset if it is kept, used or acquired as an investment, to be used in a business or as a part of a profit-making scheme. If your crypto does qualify as a personal asset, personal assets acquired for less than AUD10,000 will be disregarded for Capital Tax Gains (CGT) purposes.

When considering cryptocurrency trading, you will have to look into several scenarios to see how it will affect your tax returns.

Running a Crypto Exchange

In this case, income tax will be applied to all the profits you earn.

Using Cryptocurrency in Your Business

If you use crypto in your business for different transactions, such as receiving payments from customers or paying for goods and services for the business, you should note that these transactions will be subjected to GST.

Cryptocurrency Mining

Any profit that you make through mining cryptocurrencies will count towards your assessable income.

Crypto Trading

If you trade Bitcoin or any other crypto and earn a profit, that income will be a part of your assessable income.

It must be noted that a CGT event may occur when you dispose your crypto through one of the following transactions:

- Gifting or selling cryptocurrency;

- Exchanging or trading crypto (this also includes trading one cryptocurrency for another);

- Converting cryptocurrency into fiat currencies such as Australian dollars;

- Buying goods and services using crypto.

If you make a profit from any of these cryptocurrency disposals, some or all of those gains will be taxed.

Cryptocurrency Investments

If you have invested in cryptocurrencies, any profits you earn will be taxable. Here, it is important to remember that you will only make a capital gain or a loss when you dispose of the cryptocurrency.

In order to report your crypto income in your tax return, you will have to keep accurate records about your cryptocurrency transactions. Some things that you should keep track of include:

- Value of the cryptocurrency during the time of transaction in Australian dollars (make sure that you use a reliable online exchange rate);

- Timestamp of the transaction;

- Reasons for the crypto transaction;

- Who are the other parties involved in the transaction (just recording their cryptocurrency address is sufficient).

Apart from this, you should also keep your:

- Exchange records;

- Receipts for cryptocurrency purchases and transfers;

- Records of legal, accountant and agent costs;

- Records of digital wallets;

- Software costs related to your crypto tax management.

Sounds complicated? Keeping track of this plethora of documents and transactions can give you a headache. For this reason, you should get in touch with tax experts to handle your crypto tax returns.

About the Guest Author

Sid Cachuela is a Chartered Accountant/Financial Planner who is passionate about helping businesses and individuals achieve their goals. Sid co-founded POP Tax in order to refresh and reinvent a better way of delivering accounting and financial services that truly engages people.