Key Points 📌

🤔 What is Ripple? The native cryptocurrency of the Ripple network.

🛠️ How it Works: Facilitates fast and low-cost cross-border transactions.

💰 Tokenomics: All tokens created at inception, with tokens released periodically into the market.

📊 Why Choose Ripple? Speed, cost-efficiency, and liquidity.

⚠️ Potential Risks and Criticisms: Legal and regulatory challenges.

🚀 Getting Started: Buying, storing, and using XRP.

📚 FAQ: Your top questions, answered.

Introduction 🌟

Dive into this short guide to explore XRP, the digital asset native to the Ripple network, its operation, unique tokenomics, and more.

What is XRP? 🌐

XRP is engineered to facilitate rapid and economical cross-border transactions. It’s the backbone of Ripple’s ambition to transform global finance by making money transfers swift, low-cost, and reliable. It operates on the Ripple protocol, ensuring real-time settlement capabilities, and continues to be a choice for real-time settlements globally.

How it Works 🛠️

The magic of XRP lies in its operational protocol. Here’s how it stands out:

- Speed: XRP transactions are lightning-fast, usually settling within 3-5 seconds

- Cost-Efficiency: The average transaction fee is a mere $0.0002, making it a cost-effective choice for cross-border transactions

- On-Demand Liquidity (ODL): Ripple’s ODL service dramatically reduces the cost and settlement time for cross-border transfers. In 2022, Tranglo, a Ripple partner, saw over $3.3 billion in transfers with 80% of these transactions concluded in real-time without any latency.

Tokenomics 💰

XRP’s architecture is unique:

⛏️ Pre-Mined Supply: The inception of Ripple saw the creation of 100 billion XRP tokens.

🔄 Distribution : A substantial portion resides with Ripple, which are periodically released into the market through a structured program.

🔥 Burn Rate : Each transaction sees a minor quantity of XRP ‘burned’, reducing the total supply over time.

Why Choose Ripple? 📊

XRP presents a compelling set of advantages:

⚡ Speed Transactions are executed within a mere 3-5 seconds.

💵 Cost-Efficient: The transaction fees are a fraction compared to conventional channels.

🏦 Liquidity: XRP is easily tradeable on many platforms, enhancing its accessibility.

Potential Risks and Criticisms ⚠️

XRP is not without its risks:

⚖️ Legal Challenges: Ripple had encountered regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC), although recent developments have been favourable.

🏢 Centralisation Concerns: Detractors argue XRP leans towards centralisation compared to its crypto counterparts.

Getting Started 🚀

Keen to interact with XRP?

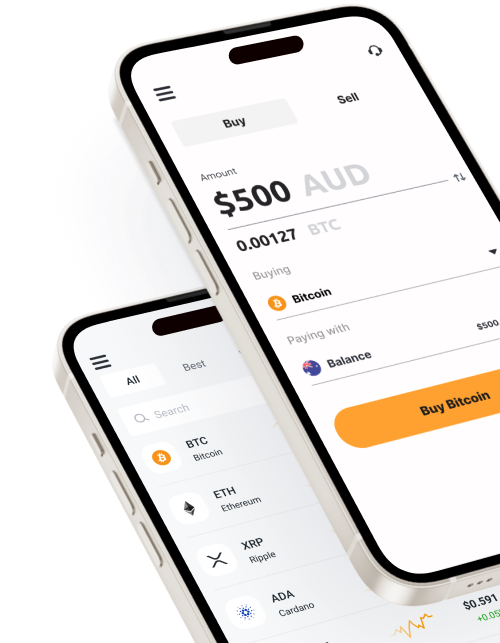

🛒 Buy XRP: You can buy XRP on Bitcoin.com.au.

🗄️ Store XRP: Hardware wallets like Ledger for long term storage, or browser based wallets like Metamask or Exodus for on the go transactions.

💸 Transfer Funds: Use XRP for quick and cheap transfers.

FAQ 📚

🤔 What is XRP? It’s the digital currency of the Ripple network aimed at facilitating fast, low-cost cross-border transactions.

🛒 How do I buy XRP? You can buy XRP on Bitcoin.com.au.

⚖️ Is XRP centralised? The debate around XRP’s centralisation primarily revolves around Ripple’s control over a large portion of the XRP supply.

Conclusion 🎯

XRP offers an enticing blend of speed and cost-efficiency in transacting, but does have its share of criticisms around regulation and centralisation. Being well-informed is key.

Further Reading 📚

Looking for a deeper dive? The world of XRP holds more chapters for your exploration: