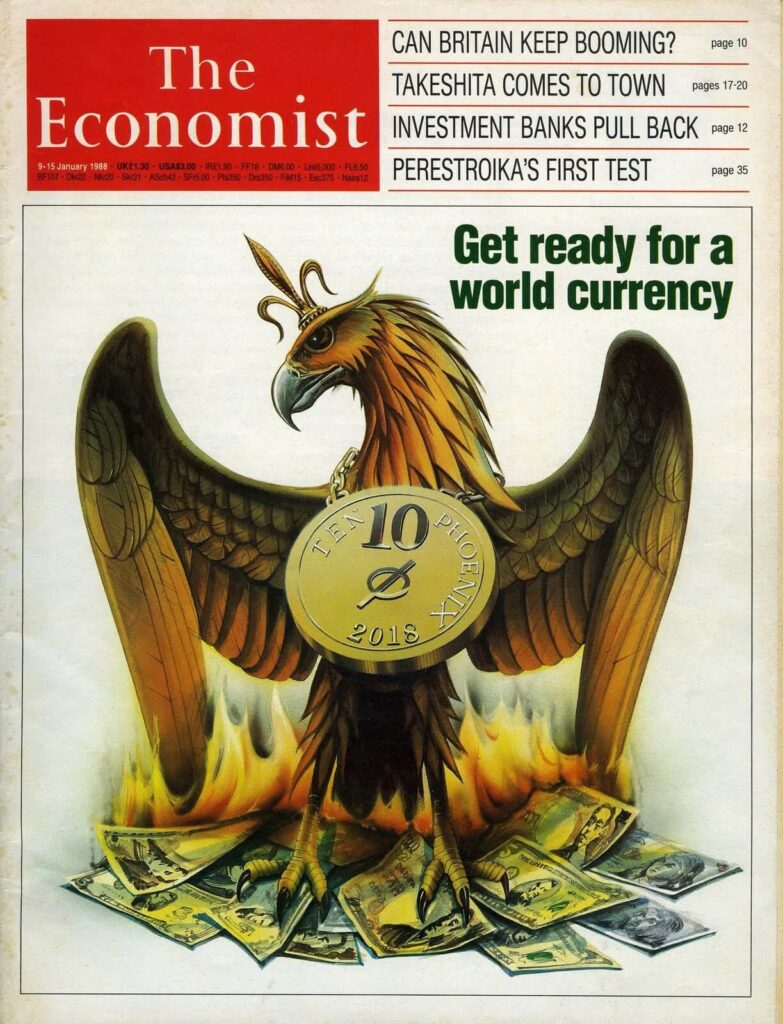

The Economist magazine published a January 1988 article titled Get Ready for the Phoenix. Thirty years later, has the phoenix risen at last?

According to Micky.com, the answer is (probably) yes. The news website released a post yesterday about the so-called ‘bitcoin conspiracy’. But before we wade any deeper, what is all this about?

Pictured below, the magazine cover shows a phoenix bird rising from the ashes of burning American money. At the centre of the page, a bronze coin engraved with the words ‘Ten Phoenix 2018’ shines bright.

The cover advertises the magazine’s leading story in which the author suggests a single unified currency could ease international financial woes.

The article’s author, anonymous behind an editorial team alias, envisages a modern world connected like never before. Instead of the Yen or Peso or Rupee, the Phoenix Coin would dominate. There would be no need for expensive international currency transfers or cumbersome money wires.

Everyone would be using the same coin; the Phoenix Coin.

Rediscovered by cryptocurrency enthusiasts in the 2000s, many believe the image is a prediction come true. So did The Economist foresee the creation of Bitcoin three decades ago?

Alongside the unknown identity of Satoshi Nakamoto, the Phoneix Coin cover is one of the crypto community’s most infamous founding legends. Read on as Bitcoin Australia investigates the mystery.

The Biggest Crash in History

Five months before the article was published, crisis struck.

In October 1987, the infamous Black Monday stock market crash stimulated by rising interest rates rocked the financial world. From Hong Kong to New York to London, the effect was devastating.

Over 24 hours the Dow dropped a staggering 22.6%, even lower than during the market crash preceding the Great Depression. In a mad panic, traders and executives crowded exchange floors around the world. They had a prime view as stocks, once worth millions of dollars, lost their value in seconds.

Black Monday remains the biggest single-day market drop in history and triggered a global wave of doubt in mainstream financial institutions.

Earlier that year, the Louvre Accord and its predecessor the Plaza Accord both tried (and failed) to stabilise the falling US dollar. People could see that something was wrong, but were helpless to stop it.

It is no surprise then that many were curious about other ways to manage economies around the globe.

Global Conspiracy?

“Thirty years from now, Americans, Japanese, Europeans, and people in many other countries […] will probably be paying for their shopping with the same currency.”

Two things tipped off the conspiracy theorists: the date and the shape.

Stamped with ‘2018’, the artist’s rendering of the Phoenix Coin shows its mint date as this year. Coincidentally (or not), Bitcoin and other cryptocurrencies have reached an unprecedented level of global popularity over the past 12 months.

For some Twitter users, this could mean big market moves soon.

The Rothschild’s Economist magazine predicted a new world currency on January 9, 1988. Isn’t cryptocurrency a globalist’s 30 years idea for a global currency? Will the stock market crash or Bitcoin will take off on October 10 or November 11? @bensemchee @Timing_BITCOIN #BTC pic.twitter.com/8HWGlhjT5X

— VN (@vietnguyen) October 6, 2018

Moreover, the Phoenix Coin looks suspiciously similar to most depictions of bitcoin.

However, the Economist has since written several articles exploring the benefits of a single decentralised global currency. And none of these articles mentioned a Phoenix Coin or bitcoin.

…Or Publishing Fluke?

A decade after the first phoenix article was published, The Economist released a second call to action titled One World, One Money. “Here is an idea: a global currency union,” says the writer. “Let nobody call it boringly feasible, or politically expedient.”

The article hawks the virtues of using one global currency and casts doubt on the stability of floating exchange rates. According to the article, the international financial ecosystem has a choice:

- The world can choose to “turn back the clock on financial integration.”

- Otherwise, the world must combine integration with fixed exchange rates — a currency union.

In Conclusion

While it is tempting to theorise conspiracy, reality is often rather boring.

After examining the information available to the public, it is unlikely The Economist hired a Nostradamus to predict the invention Bitcoin.

In fact, the idea of a single global currency has been floating around for thousands of years. The Grecian silver drachma went viral in the fifth century BCE, when conquering armies imposed the currency on foreign territories. Later, the Arabian dinar stole the limelight as Islamic knowledge and goods circulated through Northern Africa and Asia.

But until now, the possibility of a decentralised international currency has not existed. So while Phoenix Coin cover theory proponents can find enjoyment in coincidence, we mustn’t forget that most ideas are not new at all.