So you’ve navigated the crypto market and are now holding a handsome amount of Bitcoin in your digital wallet. But how do you convert that digital currency into tangible cash in your bank account? Wondering how to cash out of Bitcoin? Here’s a detailed guide on five ways you can cash out your Bitcoin.

Table of contents:

- Bitcoin ATMs

- Bitcoin Debit Cards

- Peer-to-Peer (P2P) Exchange

- Cryptocurrency Exchange like Bitcoin.com.au

- Over-the-Counter (OTC) Trading

- What is Bitcoin?

- What Must I Consider Before Cashing Out my Bitcoin?

1. Bitcoin ATMs

Bitcoin ATMs are physical machines where you can sell Bitcoin and withdraw cash. Much like a traditional ATM, a Bitcoin ATM allows you to cash out Bitcoin directly to your bank account or sometimes even to the same bank account linked with the ATM.

Fees and security considerations when using a Bitcoin ATM

Bear in mind that Bitcoin ATMs come with transaction fees, which are typically higher than those associated with regular ATMs.

Pros and cons of Bitcoin ATMs

| Pros | Cons |

|---|---|

| Easy to use and beginner-friendly. | High transaction fees. |

| Immediate transaction. | Lower security than online wallets. |

| Anonymity if no KYC is required. | Limited availability. |

| Fiat to crypto conversion. | Often have buy/sell limits. |

2. Bitcoin debit cards

A Bitcoin debit card links directly to your crypto wallet, allowing you to spend your Bitcoin at traditional points of sale. When you’re ready to sell Bitcoin, simply swipe your crypto debit card or scan the QR code, and the equivalent dollar value is deducted from your Bitcoin balance.

Fees and security considerations when using a Bitcoin debit card

Using a crypto debit card incurs various fees, including transaction fees, withdrawal fees, and even an exchange rate when converting Bitcoin to fiat currency.

Pros and Cons of Bitcoin Debit Cards

| Pros | Cons |

|---|---|

| Allows spending Bitcoin like fiat money. | Conversion fees may apply. |

| Wide acceptance where regular cards are used. | Dependent on card issuer policies. |

| May come with cashback or reward programs. | Not fully anonymous. |

| Simplifies crypto to fiat conversion. | Could be considered a taxable event. |

3. Peer-to-Peer (P2P) exchange

Peer-to-peer exchanges enable you to sell Bitcoin directly to other users. This form of peer to peer selling can be beneficial, especially when you’re trying to sell crypto at a specific price.

Fees and security considerations when exchanging on a P2P marketplace

As with all transactions, selling Bitcoin on a peer-to-peer exchange incurs a fee. Always ensure the platform you choose has robust security measures.

Pros and cons of Peer-to-Peer exchanges

| Pros | Cons |

|---|---|

| Allows direct trading between parties. | Can be susceptible to scams. |

| More privacy and anonymity. | Transactions can take time to complete. |

| Can support many payment methods. | Less regulatory oversight. |

| Might bypass some governmental restrictions. | Lack of advanced trading tools. |

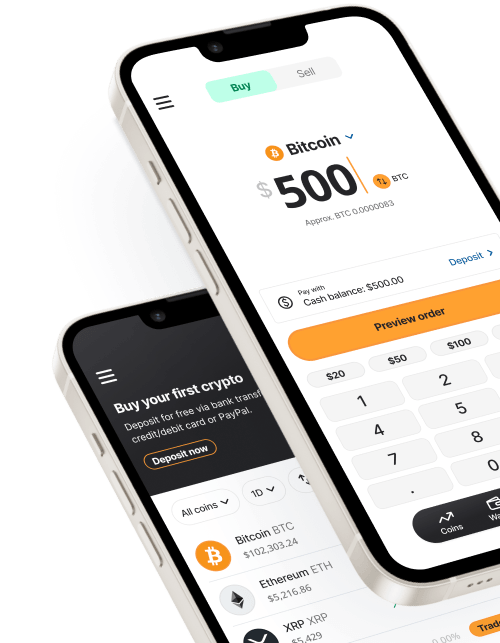

4. Cryptocurrency exchange like bitcoin.com.au

Cryptocurrency exchanges like bitcoin.com.au are platforms where you can sell Bitcoin and transfer the proceeds directly to your bank account. These crypto exchanges make cashing out Bitcoin a breeze.

Fees and security considerations when selling on a cryptocurrency exchange

When you sell Bitcoin through a centralised Bitcoin exchange, you’ll incur transaction fees. It’s also crucial to consider the tax implications of selling Bitcoin.

Pros and cons of cryptocurrency exchange

| Pros | Cons |

|---|---|

| Wide selection of cryptocurrencies. | Vulnerable to hacking. |

| Advanced trading tools and features. | May require KYC/AML procedures. |

| Typically high liquidity. | May be subject to governmental oversight and regulations. |

| User-friendly for various skill levels. | Fees can vary and may be high. |

5. Over-the-counter (OTC) trading

Over-the-Counter (OTC) trading involves a broker exchange, where you can sell Bitcoin directly to a third party broker. This method is typically used for large Bitcoin transactions and can help mitigate the impact of large sales on the Bitcoin price.

Fees and security considerations when selling Bitcoin through over-the-counter trading

While OTC trading might avoid price slippage, it still incurs fees. These trades are typically handled by third-party broker exchanges and must comply with anti-money laundering laws.

Pros and Cons of OTC Trading

| Pros | Cons |

|---|---|

| Suitable for large transactions. | Not suitable for small investors. |

| Doesn’t influence market prices. | Requires trust between parties. |

| Provides more privacy. | Can lack transparency. |

| Might offer better rates for large volumes. | Less regulated than exchanges. |

What is Bitcoin?

Bitcoin is the world’s first cryptocurrency, designed to allow financial transactions without the need for a centralised authority. It’s a form of digital currency that can replace traditional currencies, allowing users to trade directly with each other, “peer to peer.”

What must I consider before cashing out my Bitcoin?

Exchange fees:

Consider the transactional costs and the fees of transferring the funds to your bank account. These can eat into your profits, especially for smaller transactions.

Tax implications:

Selling Bitcoin might lead to capital gains tax, depending on your jurisdiction. Always seek advice from a tax professional for clarity on this aspect.

Market conditions:

The value of Bitcoin is volatile, so it can be prudent to wait for favourable market conditions before selling your Bitcoin.

Speed:

The time it takes to cash out Bitcoin varies based on the method you choose. If you need to access funds quickly, you’ll need to choose a faster cash-out method.

There you have it! Five ways to cash out your Bitcoin, along with essential considerations to keep in mind. Always remember, investing in Bitcoin, or any cryptocurrency, should be done carefully, considering your financial situation and risk appetite. Happy crypto trading!