Contents

- Bitcoin Halving Explained

- A Timeline of Past Bitcoin Halvings

- Bitcoin Halving Myths

- Frequently Asked Questions

Bitcoin Halving Explained

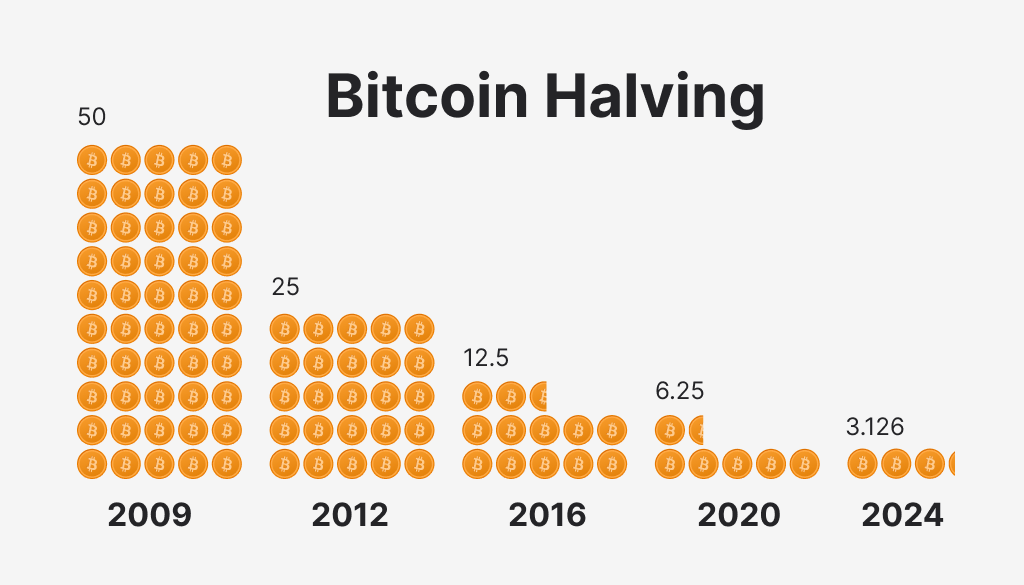

The Bitcoin halving is an important event in the cryptocurrency space where the rate of new Bitcoins being created is halved. This event occurs about every four years and is designed to slow down the creation of new Bitcoins until the cap of 21 million is reached. This mechanism is part of Bitcoin’s design to control inflation and mimic the scarcity of finite resources like gold.

The upcoming halving is set to occur on April 20th 2024 and will reduce the block reward for mining from 6.25 to 3.125 BTC per block.

Between now and the Bitcoin halving, we’re offering $10 of FREE Bitcoin for new customers. Click here to claim your $10 (T&Cs apply, offer only available to new customers)

A Timeline of Past Bitcoin Halvings

Let’s travel back in time and explore the last three Bitcoin halvings which occurred in 2012, 2016 and 2020.

First Halving (2012)

The first Bitcoin halving took place on November 28, 2012 and slashed the block reward from 50 BTC to 25. On the day of the halving, Bitcoin’s price stood at around $11.64, but quickly spiked up to $39 within a span of 100 days after the event. Within one year, BTC’s price surged to a high of $1,133.89.

Second Halving (2016)

The second Bitcoin halving, which took place in 2016, decreased the block reward from 25 to 12.5. Again, it was only after a year that BTC saw an exponential surge to a peak of approximately $25,000 in December 2017. This increase could also be attributed to the increased acceptance of cryptocurrencies and the emergence of initial coin offerings (ICOs) during this time as well.

Third Halving (2020)

When the third halving occurred on May 11, 2020, it decreased the block reward to 6.25 BTC. Despite this event not resulting in an immediate price increase – likely because external factors such as coronavirus – Bitcoin continued to spike to an all time high in late 2021 peaking at over $85,000.

Bitcoin Halving Myths

As the Bitcoin halvings become more well-known each year, so do misconceptions surrounding them. Let’s dispel some of these misunderstandings by shedding light on what actually happens during halvings.

1. Guaranteed Price Increases

There is a common misunderstanding that the Bitcoin halving will always cause its price to rise. Historical data does indicate this has happened in the past, yet no one can be certain of what future events may bring due to market demand and external factors like regulation or global economic conditions. It is important for those interested in investing not to look at historical increases as an assurance, but instead, weigh up all available data to make informed decisions.

2. The End of Bitcoin Mining

The Bitcoin halving process has sparked a myth that it will eventually lead to the end of Bitcoin mining. Some people think miners will not be incentivised to continue to secure the network once all 21 million Bitcoins are mined. This is an inaccurate assumption as miners also receive transaction fees and these aren’t going away anytime soon.

As block rewards diminish over time on the Bitcoin network, transaction fees become increasingly important in providing incentives for miners who work hard to secure the ecosystem by processing transactions.

Frequently Asked Questions

When is the next Bitcoin halving?

The upcoming Bitcoin halving is projected to take place around April 20th 2024. The block reward will decrease from 6.25 to 3.125 Bitcoin per block.

How do miners adapt to reduced block rewards?

Mining operations need to become more efficient, and miners may need to switch to more profitable alternatives in order to make up for reduced block rewards. Miners must take steps to reduce overhead costs, enhance their mining processes, and explore alternative sources of rewards such as transaction fees to remain profitable with reduced block rewards.