![Bitcoin vs Ethereum: What’s the difference? [2024 Update]](/wp-images/bitcoin-vs-ethereum-whats-the-difference-2023-update/0x_kami_orange_3D_render_bitcoin_vs_ethereum_orange_3D_gradient_c4ede3b9-68db-4b6e-9ab6-a39fada38019-1024x585.png)

When it comes to cryptocurrency, Bitcoin and Ethereum are the two dominant players. Both offer unique benefits for investors as well as users. But what really sets them apart?

In this post we will analyse both the Bitcoin and Ethereum networks – examining their beginnings, structures and use cases so you can make an educated decision between the two.

Short summary

- Comparing Bitcoin and Ethereum reveals distinct differences in their consensus mechanisms, scalability solutions, use cases and security features.

- Both have large market caps due to their respective strengths but offer different functionalities – Bitcoin as a digital currency & Ethereum for smart contracts & decentralised apps.

- Investing in either requires research into the risks associated with each cryptocurrency before diving in.

Contents

- Understanding Bitcoin and Ethereum

- Comparing the Networks: Bitcoin vs Ethereum

- Functionality and Use Cases

- Market Capitalisation and Popularity

- Assessing Transaction Fees and Speed

- Security Features and Risks

- Which Cryptocurrency is Right for You?

- Summary

- FAQ

Understanding Bitcoin and Ethereum

Bitcoin and Ethereum have revolutionised the financial system by introducing a decentralised, blockchain-based infrastructure that allows for peer-to-peer transactions without needing to depend on any third party. Bitcoin was introduced in 2009 as an alternative payment method compared with traditional fiat currencies. It is also used as a store of value and medium of exchange.

On the other hand, Ethereum (launched in 2015) harnesses the power of blockchain technology to create smart contracts along with dApps (decentralised applications). Even though there are many similarities between both these cryptocurrencies such as applying distributed ledger technologies, their main purpose and utilities differ from one another significantly.

The birth of Bitcoin

In 2009, Satoshi Nakamoto unleashed Bitcoin as the world’s first decentralised digital currency. Its structure enabled transactions between peers without having to rely on a central authority thus providing an alternative to established financial systems. The impact of this technology was significant and has increased exponentially since then, firmly establishing itself as one of cryptocurrency’s most popular members within its blockchain network across the globe. True decentralisation remains at Bitcoin’s core, distinguishing it among all other existing cryptocurrencies.

Ethereum’s emergence

Bitcoin introduced cryptocurrencies to the world, but it was Ethereum that opened up more possibilities for this new technology. Led by Vitalik Buterin in 2015, the aim of Ethereum’s decentralised network was to provide an avenue wherein developers could create projects and applications utilising its blockchain capabilities such as smart contracts.

Ether (ETH), a native cryptocurrency formed specifically within this platform, serves as fuel facilitating transactions onsite while simultaneously driving investments from around the globe thus pushing Ether’s market cap into second place behind Bitcoin among all other existing cryptocurrencies today.

Comparing the networks: Bitcoin vs Ethereum

When looking into the basic infrastructures of Bitcoin and Ethereum, there are clear discrepancies in their consensus protocols and scalability solutions. Both networks make use of a decentralised blockchain for transaction validation, but handle network assets differently, which impacts both performance and security while dictating what the cryptocurrency is best suited for.

The distinction between these two digital currencies not only affects how transactions are approved, but also sets apart respective usage applications.

Consensus mechanisms

The blockchain network needs a consensus mechanism to maintain security of transactions, and Bitcoin makes use of the Proof-of-Work (PoW) system. This requires miners to invest hefty computational power in order to verify each transaction and add new blocks on the chain. By contrast, Ethereum has shifted away from PoW to an energy efficient alternative called proof-of-stake (PoS). In this method, validators “stake” their cryptocurrency as collateral for verifying proposed transactions before adding them onto the ledger or blockchain with significantly less resource consumption than that required by Bitcoin’s mining process.

Scalability solutions

The scalability of blockchain networks is a key concern as transaction volumes increase, which can lead to network congestion and higher fees. In response, Bitcoin has implemented solutions like SegWit and the Lightning Network that help reduce transactions sizes and perform off-chain operations respectively. On the other hand, Ethereum is exploring on-chain options such as sharding, Plasma, and Casper with an aim to maximize its performance by improving capacity on their network. Both protocols have diverse strategies for scaling according to their own objectives and priorities.

Functionality and use cases

Both Bitcoin and Ethereum have their foundations in blockchain technology, but they are quite different when it comes to what they provide. As a form of digital currency, Bitcoin allows for secure peer-to-peer transactions as well as being a store of value. Ethereum’s purpose is distinctly separate from its predecessor. It provides developers with an environment tailored towards creating sophisticated tools like decentralised apps and smart contracts so they can take advantage within the blockchain framework.

Bitcoin’s role as digital currency

Bitcoin has been widely adopted and embraced as it eliminates the need for a central body, such as banks or payment processors. This brings great freedom of finance to users while minimising their transaction expenses. Due to its volatile price along with limited acceptance of payments, utilising this method can pose difficulties when attempting adoption on a large scale.

Ethereum’s versatility

Ethereum’s tremendous potential is found in its capacity to develop and deploy smart contracts as well as decentralised apps. These are agreements which are written into code, eliminating the requirement for a third-party or intermediary during transactions. This has attracted an extensive developer base that takes advantage of Ethereum’s blockchain solutions such as DeFi applications, NFTs, and other related products.

Market capitalisation and popularity

Cryptocurrency market capitalisation is a measure of its worth.. Bitcoin being the first and best-known digital currency has remained the top crypto coin by market capitalisation. But as more people adopt crypto into their lives (along with its vast ecosystem), investors are becoming increasingly aware that Ethereum’s value should not be ignored. Both these cryptos have fervent supporters behind them for different reasons, yet they stand out amongst one another depending on what advantages each offer to users.

Market cap comparison

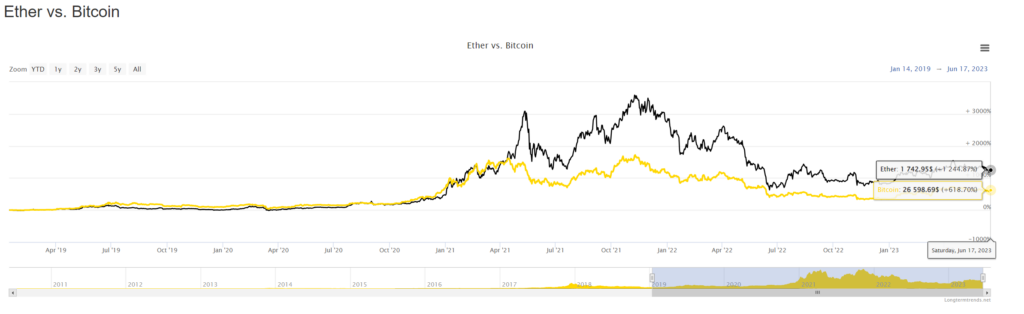

The market capitalisation of Bitcoin is significantly larger than that of Ethereum, indicating its clear dominance over the cryptocurrency landscape. This figure can be calculated by multiplying a token’s circulating supply with its current price. Several factors contribute to why Bitcoin has such a large market cap, notably limited availability in circulation as well as high public recognition and acceptance rates. In contrast, despite rapid growth recently achieved by Ethereum, it still has a lower market cap for now – but with the increasing amount of use cases and builders on the network, it could potentially one day rival Bitcoin.

Assessing transaction fees and speed

The practicality and efficiency of a cryptocurrency for everyday use largely depends on two key factors: transaction fees and speed. Bitcoin takes the POW (proof of work) approach, while Ethereum utilises POS (proof of stake), leading to different speeds and costs incurred by users. To help users choose which crypto is best suited for their requirements, they must understand the distinctions between these cryptocurrencies’ approaches to processing payments. Transaction rates vary with both Bitcoin and Ethereum. Understanding how they differ allows consumers to make smart decisions about using either currency for their needs regarding financial transactions.

Bitcoin Transaction Fees and Speed

The fees associated with Bitcoin transactions can vary depending on the network congestion and data volume. Transactions usually take anywhere from 10 minutes to an hour, but this timeframe can change depending on how congested the network is. Although optional, a higher transaction fee can motivate miners to put priority on certain transfers which will lead them to be processed faster.

Ethereum transaction fees and speed

Ethereum requires a certain sum of ether, converted to gas, for the processing of transactions and fees can vary due to network demand and gas prices. On average, these cost about 0.51 USD per transaction, which is expensive. More expensive than Bitcoin’s optional costs, but with faster confirmation times. Blocks are added every 12-15 seconds, allowing users faster access to their funds once approved by the blockchain.

Security features and risks

When it comes to security, both Bitcoin and Ethereum make use of tough measures that secure their users as well as networks. Safeguards consist of encryption algorithms, distributed systems, plus consensus methods in order to uphold the validness and safety of transactions performed on each network

Bitcoin’s security measures

When using the Bitcoin network, users must remain vigilant and take precautions as the threat of hacks or theft is still present. To protect user assets, maintain network integrity, and maximise security measures, the Bitcoin network makes use of a proof-of-work consensus mechanism.

Ethereum’s security measures

Ethereum’s defence measures centre on shielding its network and users by utilising access controls, smart contracts security patterns, and Ethereum blockchain’s consensus protocol. Developers are expected to comply with best practices for protecting their DApps as well as other smart contract codes.

Which cryptocurrency is right for you?

When choosing whether to invest in Bitcoin or Ethereum, it is important to consider one’s own risk tolerance and objectives. Bitcoin has been accepted by many for its peer-to-peer transactions as well as being used as an asset store of value. On the other hand, Ethereum provides decentralised applications with a versatile platform that supports smart contracts, which offers users plenty of options when interacting on the network. To decide what cryptocurrency fits your investing needs best, you should take into account their unique features, uses cases and risks associated with each type before making a decision based upon your investment strategy.

Investing in Bitcoin

When it comes to investing, Bitcoin presents many advantages such as its ease of access and decentralised structure. As a form of digital currency that facilitates fast transactions around the world, investors have viewed Bitcoin as an effective way of diversifying their portfolio due to its hedging capabilities against market volatility.

There are still drawbacks when it comes to investing in Bitcoin. The primary issues being significant price fluctuations, and limited acceptance across certain regions for payment processing.

Investing in Ethereum

Investing in Ethereum can be rewarding as the platform offers access to a vast world of decentralised applications and smart contracts. An ever-growing network, substantial developer community and host of projects created on its backbone make it an appealing choice for investors looking to invest in decentralisation.

Summary

Ultimately, Bitcoin and Ethereum offer a variety of advantages for their users, from digital currency transactions to decentralised applications. Both currencies serve different purposes – Bitcoin is great as a store of value that provides peer-to-peer security, and Ethereum allows access to smart contracts and the development of decentralised programs. By understanding the nuances each cryptocurrency offers in terms of risk factors versus potential return on investment, one can make an educated choice between these two cryptos when deciding which would better suit individual needs.

Frequently asked questions

Is it better to buy Bitcoin or Ethereum?

When deciding which cryptocurrency to invest in, Bitcoin or Ethereum, one must consider their personal goals and how much risk they are willing to take. While it is true that Bitcoin is more widely known, Ethereum may offer greater rewards in the future, but the risks tend also to be higher. Before investing any money into either option, thorough research should be conducted.

Will Ethereum ever surpass Bitcoin?

No one can definitively say what the future holds. Cases can be made on both sides for whether Bitcoin or Ethereum will prevail long term as the leading cryptocurrency. One thing is for sure though, decentralisation has been an underlying feature within both digital coins since inception making them two of the most sought after cryptocurrency assets today.