Types of exchanges

There are two main types of crypto exchanges: centralised exchanges (CEX) and decentralised exchanges (DEX).

Centralised exchanges (CEX)

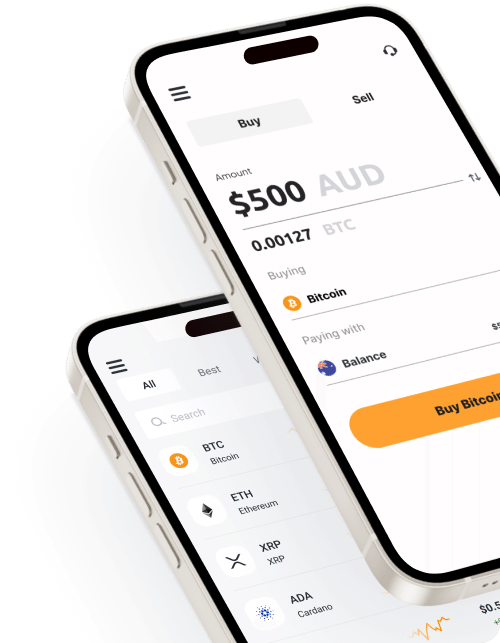

Managed by companies or central authorities, these platforms make trading straightforward and secure. They handle everything from holding your funds to processing trades, which helps streamline trading for both newcomers and experienced traders.

An example is bitcoin.com.au in Australia, known for its simplicity and reliability for the last 11 years.

Decentralised exchanges (DEX)

These operate without a central authority, such Uniswap, Jupiter, and SundaeSwap and allow you to trade directly with others using blockchain technology, giving you privacy and control.

Crypto exchanges vs. crypto wallets:

Functionality: Exchanges are the best place to easily buy and sell crypto. They include features like portfolio tracking, live price updates, and advanced tools for the pros. On the other hand, wallets are mainly for securely storing your cryptocurrencies. Watch this space, though, as new technologies and integrations are also slowly impacting wallets.

Custody: Exchanges hold your digital assets to facilitate easy trading, while wallets give you full control over your crypto, often referred to as “self-custody.”

Types of orders (trading mechanics)

Exchanges offer different types of orders on how to process buying and selling. These include:

- Market orders: Processed immediately at the current price.

- Limit orders: Processed only at a set price or better.

- Stop orders: Turn into market orders once a specific price is hit.

How do exchanges set the price of each asset?

Cryptocurrency prices are determined by supply and demand on each exchange. Prices can vary between exchanges depending on trading volume and liquidity.

How do exchanges make money?

Exchanges generate revenue through several channels:

- Trading fees: Most exchanges charge a small percentage of each transaction as a fee.

- Withdrawal fees: Exchanges may charge fees to cover network costs when withdrawing funds.

- Premium services: Some exchanges charge a fee for advanced trading tools.

Security considerations

Centralised exchanges often store large amounts of user funds and assets. To keep them safe, they use advanced security tools like two-factor authentication (2FA), cold storage, and regular security audits.

Pros and cons of crypto exchanges

| Pros | Cons |

| Convenience: Easy access to buy, sell, and trade crypto. | Control: You don’t have direct control over your assets as they are stored by the exchange. |

| Trading tools: Advanced tools for experienced traders, including real-time market tracking. | Regulatory risks: Changing regulations can lead to legal issues, and if an exchange becomes insolvent, users may lose access to their funds. |

| Security: Strong measures to protect your funds from theft and unauthorised access. | KYC (know your customer) and privacy concerns: Many exchanges require identity verification, which may be a concern for privacy-conscious users. |

How to select the right crypto exchange for you

When choosing a crypto exchange, consider the following:

- Reputation & security: Check the exchange’s history, reviews, and security measures like two-factor authentication (2FA) and cold storage.

- Regulatory compliance: Ensure the exchange is licensed and follows local regulations.

- Fees: Compare trading, withdrawal, and other fees.

- Support when you need it: Look for an easy-to-use platform with quality customer support.

- Deposit & withdrawal: Confirm the available transfer methods, such as credit and debit card, bank transfers and PayPal.

- Transparency: Look for exchanges that are upfront about their team, processes, and how they keep your funds safe.

- Trading pairs: Make sure that the exchange supports the pairs you want to trade.

- Liquidity: Check to ensure that the exchange has enough funds, which allows for quick trades at fair prices.

How to register with a crypto exchange

Whether you’re an individual or representing a company, trust or SMSF, we’ve got you covered in Australia. Click here to sign up.