Up (aka Up Money, Up Bank, or Up Banking) customers can easily buy Bitcoin in Australia by transferring funds to trusted crypto exchanges like bitcoin.com.au. Like most Aussie banks, you can’t buy Bitcoin or crypto directly with Up.

This guide covers how to set up your account, make a deposit, and purchase Bitcoin, plus key info on Up’s crypto policies and crypto tax considerations.

How to buy Bitcoin with Up

1. Create your account

To get started, create a trading account with bitcoin.com.au or another trusted platform.

You’ll need to verify your identity by providing:

- Your full name, email and date of birth

- Proof of address (e.g. utility bill, bank statement, or government notice)

- ID and selfie (e.g. passport or driver’s licence)

This is to meet Australian regulatory standards and keep your account secure.

2. Deposit Aussie dollars from an Up bank account

You can transfer Aussie dollars from Up to bitcoin.com.au using:

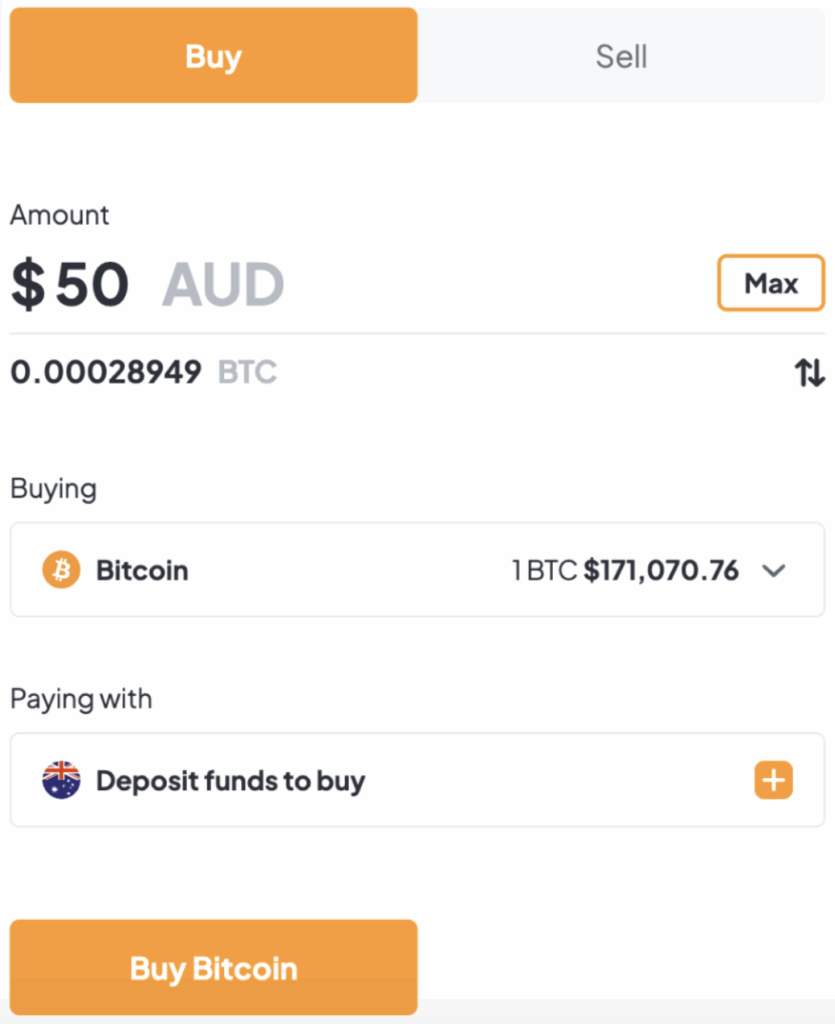

3. Buy Bitcoin with Up

Once your funds land in your account:

- Log in to your account and go to the Trade screen.

- Select Bitcoin from the list of available cryptocurrencies.

- Enter how much AUD you want to spend.

- Select Buy Bitcoin.

- Review and confirm your order.

Your Bitcoin will appear in your bitcoin.com.au account after the trade is complete.

Below is an example of the mobile app interface.

Up Bank’s crypto policies

Up generally supports transfers to AUSTRAC-registered crypto exchanges, including bitcoin.com.au and Independent Reserve. The bank is considered crypto-friendly and doesn’t impose any official monthly caps. However, occasional delays on larger or first-time transfers may occur, especially for new Up Bank customers.

We’ve come across some unverified Up customer reports claiming account closures for transferring to a handful of other crypto exchanges. Especially if planning on transferring a larger amount into crypto, consider reaching out to the bank to confirm your intended exchange and/or transaction will be supported.

Crypto tax obligations in Australia

The Australian Tax Office (ATO) generally treats crypto as an investment asset, similar to shares or property. This means that when you sell or trade crypto in a way that generates a profit, it may be subject to capital gains tax (CGT).

If you’re just buying and holding crypto without selling, trading, or using it for transactions, you won’t have to pay tax. But once you do, a crypto tax calculator can help you stay on top of what you owe.

Learn more about crypto tax obligations and tools.

Frequently asked questions

Are there any fees for buying Bitcoin using bank transfers?

- We don’t have any deposit fees for bank transfers into our platform.

- View our fee schedule for a complete list of fees and charges.

Can I withdraw AUD to my bank account from bitcoin.com.au?

- Yes, you can easily send AUD to your linked bank account.

Are there any limitations when it comes to using Up?

- Up Bank may delay your first deposit by 1 to 2 business days.

- Osko and PayID deposits are typically instant. EFT transfers may take up to 2 business days to process.

How much does it cost to buy Bitcoin in Australia?

A lot of beginner investors might not know this, but you don’t have to buy one “whole Bitcoin”. You can always purchase a fraction of a Bitcoin, or as low as $50 worth of Bitcoin – this is equal to about 0.0003 Bitcoin at the time of writing.