Cryptocurrency articles

Sign up to get the latest news from bitcoin.com.au

-

Slippage in crypto trading and how to minimise it

Paying more than expected when trading crypto? Learn what slippage is and how to reduce it, from better timing to splitting your trades.

-

How do crypto exchanges work?

Crypto exchanges are online marketplaces where you can buy, sell, and trade digital currencies, including Bitcoin and Ethereum. They’re similar to stock exchanges but focus on cryptocurrencies, giving you a place to get involved in the growing crypto market.

-

How to create an SMSF account on bitcoin.com.au

Thinking of investing in Bitcoin and other crypto with your SMSF? Creating an SMSF account is simple and can done in a few minutes!

-

Crypto Fear and Greed Index

Have you ever wanted to gain a better understanding of how emotions affect the market activity in cryptocurrency trading? The crypto fear and greed index is here to help traders make informed decisions by providing insight into shifts in current sentiments. In this blog post we will explore the components of this unique metric and […]

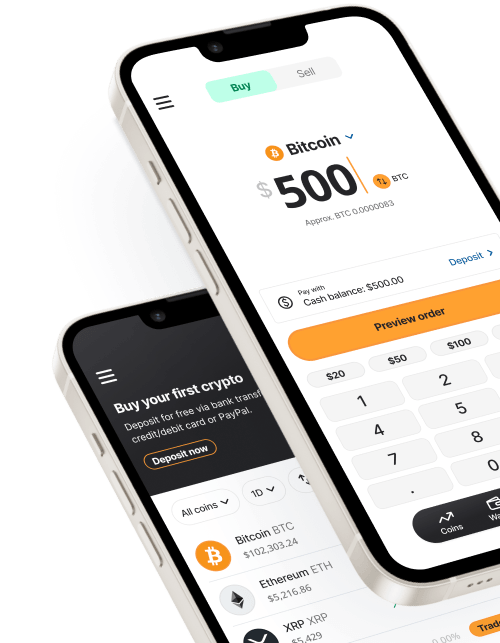

Buy crypto in Australia

The easiest way to buy Bitcoin and crypto