You’ve heard of Bitcoin. Perhaps your cousin won’t stop talking about it at family dinners, or your favourite coffee shop now accepts it. Whatever the case, you’re intrigued. But there’s one question that stands between you and your first Bitcoin purchase: “Is Bitcoin safe?”

Today we’ll delve into this question, aiming to provide a comprehensive, beginner-friendly guide to the safety of Bitcoin. We’ll unravel the mystery behind this digital currency, built upon the ground-breaking Bitcoin technology known as blockchain.

Table of Contents

- Is Bitcoin a Safe Investment?

- Risks of Investing in Bitcoin

- Understanding Bitcoin and How it Works

- Things to Know Before You Invest in Bitcoin

- Understanding Crypto Wallets: Hot and Cold Storage

- Safety Measures to Protect Your Crypto Assets

- Final Thoughts

Is Bitcoin a Safe Investment?

When it comes to investing, safety isn’t a one-size-fits-all concept. Stocks, real estate, gold – they all carry inherent risks. The crypto markets however, are particularly famous (or infamous, depending on your viewpoint) for their volatility. Despite this, Bitcoin has achieved a sort of mainstream acceptance, with millions of businesses worldwide now accepting it as payment. This is mainly due to the underlying Bitcoin technology that Bitcoin operates on – blockchain technology, which is renowned for its robust encryption and secure transaction capabilities.

Blockchain is a public ledger that houses all transaction data from anyone who uses Bitcoin. Transactions are added to “blocks” or links of code that make up the chain. Each transaction must be recorded on a block. But the beauty of this system is that it’s open source and decentralised. This means it’s resistant to censorship, operates anywhere with an internet connection, and offers transparency that’s unheard of in traditional financial systems.

Risks of Investing in Bitcoin

Bitcoin like any other asset, isn’t without its risks. The value of Bitcoin can be extremely volatile. Dramatic price swings can occur within a single day, making it a potentially risky investment, especially for crypto newcomers. However, the saying “only invest what you can afford to lose” holds particularly true here.

Additionally, while the blockchain is highly secure, there’s always a risk of hacking. But don’t panic just yet; remember, this is true for any form of digital financial transactions, even your everyday online banking.

Understanding Bitcoin and How it Works

At its core, Bitcoin is a form of digital currency, a crypto asset, that uses encryption techniques to regulate the creation of new units, secure transactions, and verify the transfer of assets. It’s independent of any central bank and operates on a decentralised peer-to-peer network called the blockchain.

Blockchain the technology behind Bitcoin, can be thought of as a transparent and tamper-proof digital ledger. Imagine a spreadsheet that’s duplicated thousands of times across a network of computers, which the network regularly updates. This network is designed to regularly update all those spreadsheets, and that’s a basic understanding of the blockchain.

Things to Know Before You Invest in Bitcoin:

Bitcoin and taxes

Selling and buying Bitcoin has tax implications. In many jurisdictions, Bitcoin is subject to capital gains taxes. You’ll need to keep diligent records of your transactions and may need to pay taxes if you sell your Bitcoin at a profit.

Unregulated territory

There’s no central authority that governs Bitcoin. It’s a peer-to-peer system, and users have full control over their transactions.

Decentralisation is key

Bitcoin is not issued or regulated by a central authority, like a government or financial institution. This decentralisation means Bitcoin operates on a level playing field, and no single entity can dictate the value of a Bitcoin.

Irreversibility is a feature, not a bug

Once a Bitcoin transaction is confirmed, it can’t be reversed. This protects merchants from fraudulent chargebacks but also means you need to be careful when sending Bitcoin.

Transaction fees

While Bitcoin transactions are not controlled by a central authority, they’re not entirely free. Miners, who validate the transactions on the blockchain, are rewarded Bitcoin, but they may also charge fees to process transactions.

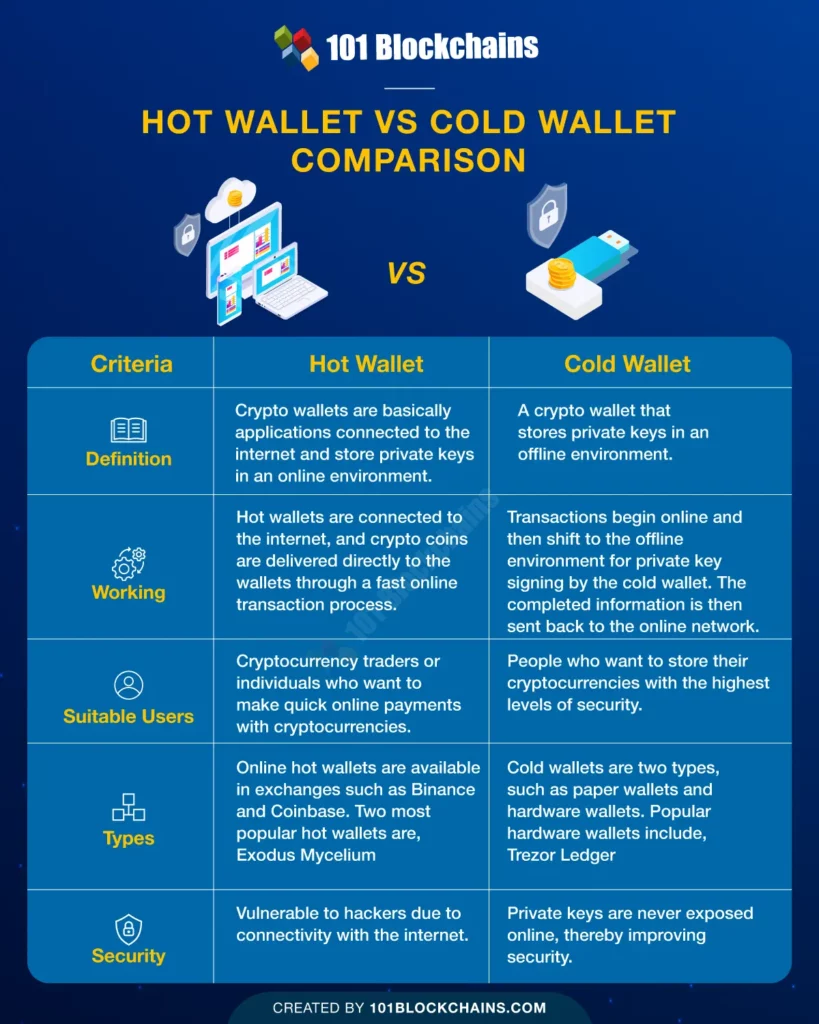

Understanding Crypto Wallets: Hot and Cold Storage

In the world of cryptocurrencies, one of the most important things you’ll need to understand is how to safely store your Bitcoin or other crypto assets. This is where crypto wallets come in.

Hot Wallet:

A hot wallet is a digital wallet that’s connected to the internet. While it provides easy access and quick transactions, it’s also more vulnerable to hacking. Examples of hot wallets include exchange wallets, mobile apps, and desktop clients. Among these, hardware wallets, which require physical confirmation of transactions, are often seen as a more secure form of hot wallets.

Cold Wallet:

For long-term storage, a cold wallet, which is not connected to the internet, is recommended. Cold wallets are less convenient for frequent trading, but they offer the best security for your crypto assets. They can be hardware devices or paper wallets, which store your private key offline.

Safety Measures to Protect Your Crypto Assets

Backup your wallet:

It’s essential to back up your crypto wallet, just like you would your phone or computer. Many digital wallets offer backup solutions, but for ultimate safety, consider using a cold storage method for the majority of your assets. Always remember, if you lose your private keys, you lose access to your Bitcoin.

Enable two-factor authentication:

Two-factor authentication is a security feature that can help protect your Bitcoin from hacking attempts. It requires not only a username and password but also something that only the user has on them – like a physical token or a code sent to their mobile device.

Use reputable cryptocurrency exchanges:

When buying and selling Bitcoin, it’s vital to use reputable cryptocurrency exchanges you trust, like bitcoin.com.au. Reputable exchanges provide a secure platform for trading and often offer additional security features.

Be aware of cryptocurrency scams:

The crypto world, like any other financial system, isn’t immune to scams. Be vigilant about offers that sound too good to be true, fake websites, and phishing attempts. Always do your due diligence and verify the authenticity of websites, apps, and platforms before sharing sensitive information.

Keep your seed phrase and MFA code confidential:

Your seed phrase – a series of words or password – is the key to your crypto assets. Similarly, your Multi-Factor Authentication (MFA) code adds an extra layer of protection. These should always be kept confidential and never shared with anyone.

Final Thoughts

As with any investment, diving into the world of Bitcoin requires understanding and caution. It’s essential to do your homework, understand the risks, and always remember that while Bitcoin’s digital nature presents unique challenges, it also offers unparalleled opportunities.

As we move towards a future where Bitcoin and other cryptocurrencies might play a more significant role in our daily lives, understanding and embracing this new technology could provide us with numerous opportunities. And who knows? Maybe someday, instead of asking, “Is Bitcoin safe?” you’ll find yourself explaining how Bitcoin works to a friend over coffee.

Stay curious. Stay informed. And as always, invest responsibly.