The Australian government is currently considering a bill that would restrict cash purchases to under AU$10,000. Many are calling the bill, targeting the black economy, a use case for cryptocurrencies.

So, what does the bill say, and what does it mean for crypto?

What the Bill Says

The full bill consists of the original draft and a set of proposed amendments backed up by supporting documents. They’re all publicly available, and you can read through them here.

The bill, Currency (Restrictions on the Use of Cash) Act 2019, should come into effect in January 2020. That is, if passed by Parliament. The purpose of the bill is to prevent tax evasion, as well as other illicit activities including terrorism and black economy activity.

The bill would limit cash transactions to $10,000. This would mean that any purchase over the limit would require using the electronic payment system or cheque. That also includes instalment payments. So, three payments of $4,000 would still count as in excess of $10,000.

Those who were caught making cash payments over that limit would be subjected to fines and/or prison time. The bill separates offences into cash payments in excess of cash payment limit

and cash payments recklessly in excess of cash payment limit

.

How exactly the government would become aware of cash payment in excess of the cash payment limit is unclear.

What It Says About Cryptocurrencies

In the initial bill draft, “cash” included cryptocurrencies. However, a series of subsequent amendments provides protection to digital currencies. As a result, the most recent publicly-available form of the bill only impacts “physical currency”.

A subsequent memo explained that the change was to prevent the hampering of cryptocurrencies and because policing them is difficult.

Digital currency is a new and developing area in the Australian economy. Unlike physical currency, it does not have an established regulatory framework or industry structure,

according to the memo. This makes it difficult to apply the cash payment limit in a way that would not largely prevent the use of digital currency in Australia or significantly stifle innovation in this sector.

The memo also says that there is little current evidence that digital currency is presently being used in Australia to facilitate black economy activities.

As a result, the Government has decided at the present time to effectively carve digital currency out from the cash payment limit.

However, it also states that this position will remain under ongoing scrutiny.

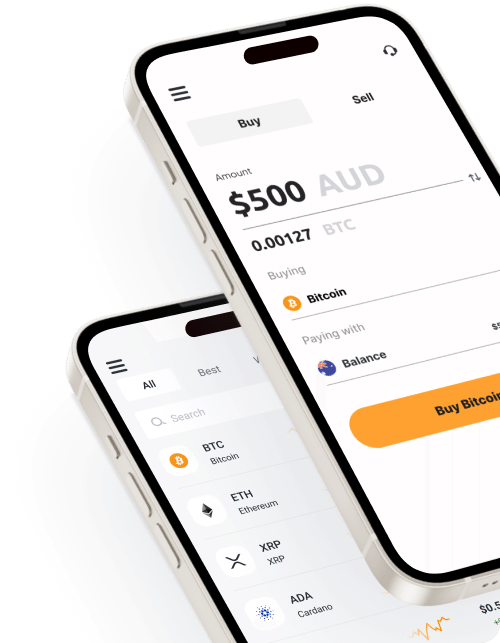

Cryptocurrencies in Australia

There are a number of reasons that this bill is significant for cryptocurrencies.

The first is as a use case. Australia is hardly the first country to propose – or enact – a cash transaction limit. Some countries have a cash transaction limit that is significantly smaller. The ability of cryptocurrencies to get around these limits is seen as a way of avoiding government control of currency.

The second is that this is the most recent in a long line of positive crypto developments, particularly in Australia. While Australian banks haven’t warmed to crypto as they have elsewhere, the government has encouraged it. Prime Minister Scott Morrison has proven to be a strong advocate for cryptocurrencies.