Key takeaways

Crypto OTC trading is a private, personalised form of trading for high-net-worth individuals and institutions, offering white glove service, deeper liquidity, and the ability to execute large transactions without a negative price impact.

OTC trading is conducted directly between two parties and facilitated by brokers. This ensures privacy and confidentiality as orders are not publicly listed on exchange order books.

Minimal market impact during large-scale transactions, direct price negotiation between buyer and seller, and the potential for better pricing terms.

Understanding crypto OTC trading

Crypto OTC trading operates uniquely outside traditional exchange order books. This form of trading is popular among users looking for a tailored, private market experience. It’s not just about buying and selling cryptocurrencies; it’s about doing so in a way that is customised to your needs, whether those involve crypto-to-crypto or fiat-to-crypto trades.

High-net worth individuals and institutional clients find OTC trading desks particularly appealing due to:

Personalisation and privacy, which allow for a concierge-like service, guiding participants through the process under favourable conditions

Deeper liquidity and tighter spreads, which offer better execution for large block trades

The ability to execute large-volume transactions without causing market disruption

The OTC trading process

The OTC trading process involves the following steps:

Client contacts the OTC desk to outline their specific trading needs and requirements.

KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures are completed to satisfy due diligence requirements set out by the OTC desk.

A negotiation takes place on the terms of the deal, including price, quantity, payment methods, and settlement options.

Once terms are negotiated and due diligence performed, we execute trades and proceed with trade settlement, ensuring the secure exchange of funds and digital assets.

Advantages of crypto OTC trading

Crypto OTC trading offers more than just personalised services; there are numerous advantages make it an attractive option for traders.

Privacy and anonymity

Privacy and confidentiality are among the most significant advantages offered by over the counter trading. Unlike traditional exchange trading, orders are not exposed on public markets, and transaction details like prices remain undisclosed. This is particularly appealing to high-profile individuals or institutions making large crypto purchases who prefer to keep their trades discreet and not registered on public exchanges.

Reduced market impact

Large transactions on an orderbook typically cause large price fluctuations. OTC trading minimises this impact by occurring off the orderbook.

This method also allows traders to establish a fixed price before the trade, minimising potential liquidity and slippage issues that may occur on traditional exchanges.

Price negotiation

Finally, OTC crypto trading provides the benefit of direct price negotiation. Prices are negotiated directly between the buyer and the seller, offering the potential for better quotes especially for large-volume trades.

Frequently asked questions

What is crypto OTC?

Crypto OTC refers to Over-the-Counter Trading, which allows for private buying and selling of cryptocurrencies outside a regular exchange orderbook. It caters to individuals and institutions seeking to execute large trades with minimal price slippage or market impact.

What are the OTC fees for crypto?

OTC fees can vary widely based on transaction specifics. To ensure you receive the most accurate information tailored to your needs, please book a consultation with our team.

What is the minimum amount to trade OTC?

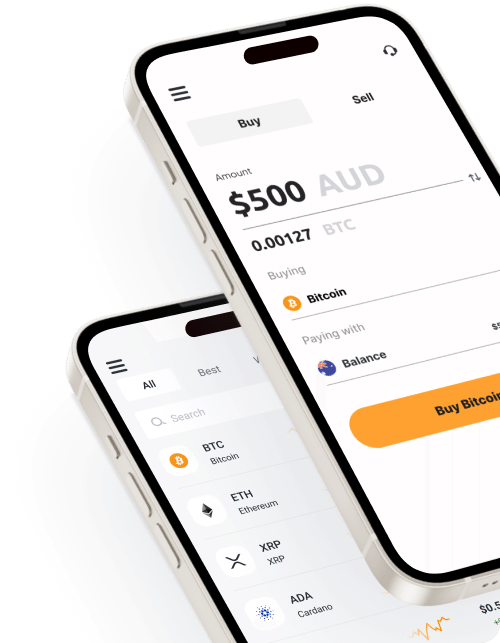

bitcoin.com.au facilitates OTC trades from $50,000 – $10+ million.

What is the process of OTC trading?

The OTC trading process begins with the trader contacting the OTC desk to outline their needs, negotiating terms, and completing KYC and AML procedures. A negotiation takes place on the terms of the deal, including price, quantity, payment methods, and settlement options. If accepted, the trade is then executed and the transaction is settled securely.