Dollar-cost averaging (DCA) is a strategy where you buy Bitcoin at regular intervals — say, weekly or monthly — regardless of the price. It’s an alternative to buying Bitcoin with a lump sum.

TL;DR: Bitcoin DCA, in plain English

- You invest small amounts regularly

- It helps smooth out the ups and downs of asset prices

- Great for beginners, no need to guess the “right time” to buy

- Works best when you stick with it over the long term

- Like any strategy, returns aren’t guaranteed, but it’s a steady, low-stress approach

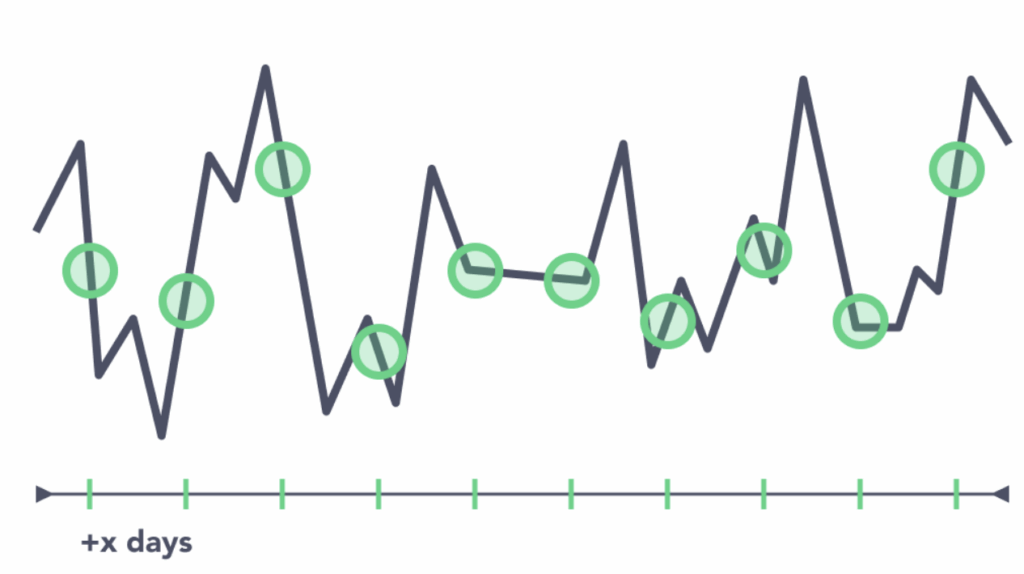

DCA in action

Below is an example of how Bitcoin dollar cost averaging (DCA) works over time. By regularly investing smaller amounts, DCA helps investors to buy more of an asset when prices are low but less when prices are high, effectively averaging the cost over time.

Chart sourced from River

Should I dollar cost average into Bitcoin?

There are two main reasons you’d look to dollar-cost-average into Bitcoin.

Scenario 1: You have a lump sum to invest

You’ve set aside $5,000 to buy Bitcoin and want the best price. Putting all that money down in one go is quick, but it comes with risks.

In an ideal world, you’d buy Bitcoin every time the price dips and get it at a discount (known as buying the dip). However, as most investors will tell you, timing the market is hard.

Professional traders trying to time the market will look into things like past Bitcoin prices, key crypto indicators, and technical analysis. However, this isn’t beginner-friendly, and past trends never guarantee future performance.

This is where Bitcoin DCA comes in. It’s beginner-friendly because you’re not trying to play the market. By breaking up your purchase over time, you smooth out the price you pay, spreading your risk and taking the emotion, time, and stress out of investing.

Example: You break your $5,000 into 12 monthly payments across the year (at roughly $416 per month).

Scenario 2: You’re starting small

Maybe your budget only allows for spending $15 a week on Bitcoin.

It might not sound like a lot, but that $15 a week adds up to $780 over a year and would have bought you roughly 0.005 Bitcoin, based on the average Bitcoin price over the past year (at the time of writing).

0.005 Bitcoin would be worth roughly $900 (as of August 1, 2025), and a ~15% return on your investment. It’s easy to see how those numbers can add up over time!

How can you achieve this with Recurring Buy?

Recurring Buy is our new feature that allows you to automate your crypto investing for building long-term wealth. It encourages consistency and is a form of dollar-cost averaging (DCA).

You can set your Recurring Buy:

- Using a fixed amount on a set schedule (for example, investing $50 on a weekly basis into Bitcoin)

- Using a percentage of their deposit (for example, allocating 25% of their incoming deposit for investing into Ethereum)

With Recurring Buy, you are in control.

Are there any downsides?

Like any strategy, DCA isn’t perfect:

- You won’t always catch the lowest price: If Bitcoin dips and then quickly rebounds, lump-sum buyers might come out ahead.

- It takes time: You’ll need patience. DCA works best as a long-term approach.

But for most everyday investors, DCA is about confidence and consistency, not chasing quick wins.

Final thoughts

Dollar-cost averaging is one of the easiest ways to buy Bitcoin.

- It helps reduce the emotional highs and lows of crypto.

- It’s a consistent, time-tested strategy.

- DCA is available to every Aussie — whether you’re investing $10, $5,000, or anything in between.

- It won’t always deliver the best returns. If Bitcoin dips and then quickly rebounds, lump-sum buyers might come out ahead.

- Ultimately, whether buying through DCA or as a lump, the best strategy depends on your personal risk appetite, financial goals and the amount of funds you have available for investing.

How to buy Bitcoin in Australia?

You can easily buy Bitcoin in Australia with a range of payment options, including:

With bitcoin.com.au, it couldn’t be easier!