The bitcoin.com.au blog

Sign up to get the latest news from bitcoin.com.au

-

Recurring Buy: A feature to automate buying Bitcoin and crypto

Want to buy Bitcoin regularly without watching the market every day? Recurring Buy is one of the easiest ways to buy Bitcoin.

Whether $5 a week or +$500 a month, choose how to invest, and we’ll do the rest!

-

Crypto withdrawal delays explained

We explain delays in crypto withdrawals, why it happens, and why we do it here at bitcoin.com.au.

-

Best Bitcoin wallets Australia 2025

Compare the best Bitcoin & crypto wallets in Australia for 2025 – hardware, software & exchange options. Stay safe and choose wisely.

-

How to buy Bitcoin with Up

Buy Bitcoin and crypto with Up. Discover how to deposit funds, key tax considerations and the bank’s crypto policies.

-

Businesses that accept Bitcoin in Australia

Here’s a handy list of who accepts crypto across Australia.

-

Native vs smart contract deposits explained

Not all crypto deposits work the same way. Some arrive instantly, while others risk being lost, and the difference comes down to whether you use a native transfer or a smart contract.

-

Best crypto-friendly banks in Australia

What makes a bank crypto-friendly in Australia? Here are tips to find the right bank for you, and important details to keep in mind.

-

How to buy Bitcoin with UBank

Buy Bitcoin and crypto with UBank. Discover how to deposit funds, key tax considerations and the bank’s crypto policies.

-

How to buy Bitcoin with Bendigo Bank

Looking to buy Bitcoin with Bendigo Bank? Look no further! We cover everything you need to know, from setting up your account to making secure, hassle-free deposits.

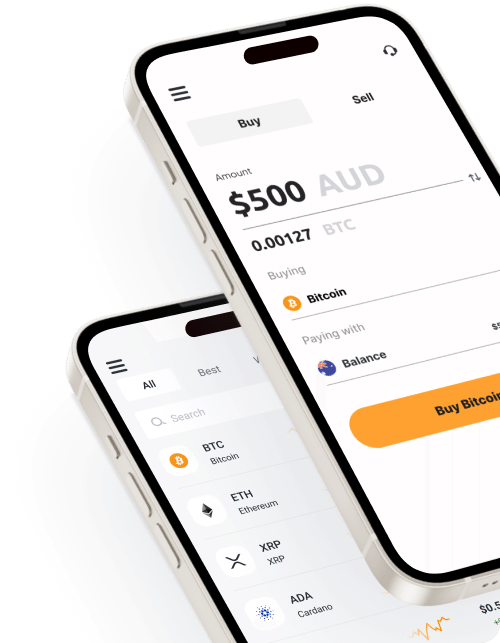

Buy crypto in Australia

The easiest way to buy Bitcoin and crypto