Have you ever wanted to gain a better understanding of how emotions affect the market activity in cryptocurrency trading? The crypto fear and greed index is here to help traders make informed decisions by providing insight into shifts in current sentiments. In this blog post we will explore the components of this unique metric and learn methods for using it when constructing strategies around buying Bitcoin and other cryptocurrencies.

Short Summary

- The crypto fear and greed index is an invaluable tool for crypto traders to measure market sentiment & make informed decisions.

- It’s composed of 6 key components, including volatility, momentum, dominance & more.

Contents

- Exploring the Crypto Fear and Greed Index

- The Components of the Crypto Fear and Greed Index

- Comparing Crypto Fear and Greed Index to Traditional Markets

- Summary

- FAQ

Exploring the Crypto Fear and Greed Index

The crypto fear and greed index is an important tool for crypto buyers who want to make smart decisions about their investments. The index measures the emotions that drive market action. It shows whether fear or greed is driving the trading of digital currencies at the moment.

To get a better idea of how this gauge works, we’ll take a closer look at its components and explain how important each is when investing in cryptocurrencies. By keeping track of these kinds of data points, you can keep an eye on changes in sentiment and be on the lookout for signs that show price movements due to fear or greed in the crypto space.

By analysing market sentiment with tools like the crypto fear and greed index, investors might get a leg up on their peers who don’t pay attention to the psychological aspects of successful investing.

What is the Crypto Fear and Greed Index?

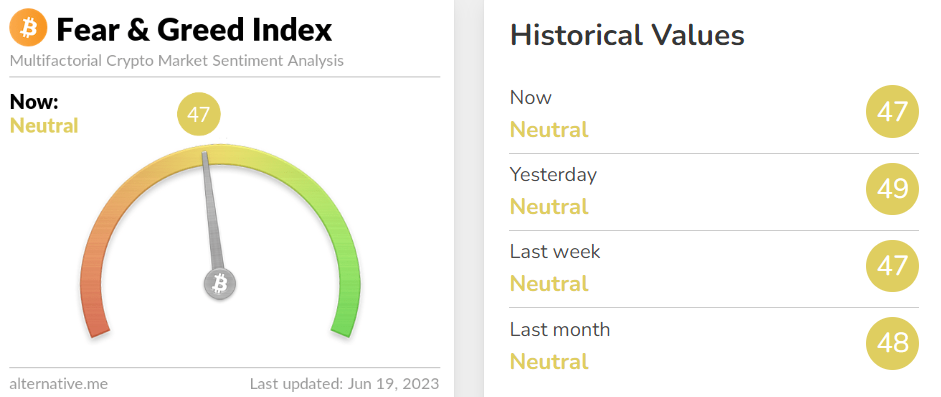

The crypto fear and greed index is a tool used to observe the current sentiment within the crypto market. It assesses multiple indicators such as volatility in prices, momentum of trading activity, commentary on social media channels regarding cryptocurrencies, Google Trends data and the dominance of Bitcoin against other assets. The index provides traders with an insight into overall market emotion from 0 – 100. Higher numbers indicate more confidence while lower figures signify greater apprehension. It is primarily designed for short-term use by allowing investors to recognise when markets enter either extreme fear or extreme greed stages making it easier for them to decide when it is best to enter/exit positions, ultimately leading towards potentially more profitable strategies & improved risk management capabilities.

Why is the Index Important?

Crypto traders rely heavily on the crypto fear and greed index to gain an insight into market sentiment at any given moment. It helps them make more rational choices when entering or exiting a trade as opposed to making decisions based solely on their own emotions. Combining this index with other technical indicators can give traders even greater clarity around current conditions in order for them to maximise the success rate of trades. It also plays a crucial role in controlling fear-driven responses that might arise due to sudden movements within the markets.

The Components of the Crypto Fear and Greed Index

The crypto fear and greed index is made up of several essential factors that give a general sense of the market sentiment. The factors include social media sentiment, volatility in the market, Bitcoin dominance ratio, and Google Trends data. Each one plays its own part which helps determine how much fear or greed exists within cryptocurrency trading activity at any given time.

In order to understand how all these elements contribute, we have to consider each individual component individually such as their relevance when evaluating current sentiments around digital assets. Collectively they provide helpful insights for users who wish plan out buying/selling strategies.

Market Volatility

The crypto fear and greed index measures the extent of market volatility by comparing it to average levels for the past month or ninety days, giving an indication of the amount of risk is present. When there’s a high degree of volatility, this usually implies extreme fear from investors who are unsure about where exactly things will go. On the other hand, low volatility signify more stability amongst trading crypto assets with greater trust in their direction going forward. By taking into account these two concepts – fear and greed – the index offers insight on current conditions within markets using cryptocurrencies like Bitcoin.

Market Momentum

The crypto fear and greed index takes market momentum into account, helping to gauge the overall sentiment in the market. An increase in buying volumes can be interpreted as a sign of higher levels of greed among investors who are more confident about prices going up. Conversely, when there is less buying activity it implies that fear is prevailing towards future price movements.

Looking at movement within these markets also gives insight on whether traders are fearful or greedy. If traders start increasing their purchases then confidence has grown, while decreasing trades reflect an atmosphere dominated by worry rather than optimism.

Social Media Sentiment

The crypto fear and greed index relies heavily on social media sentiment to gain insight into the collective mentality of traders and investors across various online networks. By closely monitoring the content, tone, and direction of conversations about cryptos in these spaces, people can form a better understanding as to what attitude currently dominates within this market.

Assessing such sentiments is far from easy due to its complicated nature. Any attempts at social media market manipulation makes gauging opinion even harder. Despite that, there’s no denying how influential social media sentiment is for interpreting feelings towards crypto trading overall with regard to fear or greed by forming part of the index.

It’s clear why social media has become an essential aspect when using the crypto fear and greed index for forecasting trends relating specifically to attitudes concerning cryptocurrency investments today.

Bitcoin Dominance

The crypto fear and greed index takes into consideration the cryptocurrency market’s Bitcoin dominance, which is a measure of Bitcoin’s share of total digital assets. When there is a higher percentage, it indicates a fear-driven marketplace as traders seek out the stability offered by BTC. Lower percentages suggest more greediness since investors are pursuing alternative crypto coins in hope for better gains.

By factoring this figure into their analysis toolkit, users can become aware of changes in sentiment within cryptocurrencies to make informed choices about investments accordingly.

Google Trends

The crypto fear and greed index utilises Google Trends data in order to provide an understanding of the market sentiment. An increase of interest shown towards crypto-related topics indicates that more people are interested in investing. Meanwhile, lower search volume for cryptocurrency indicates a fearful market with fewer individuals being curious about potential investments. By including Google Trends information within the index, traders can make more informed decisions.

Comparing Crypto Fear and Greed Index to Traditional Markets

The crypto fear and greed index is often compared to traditional market sentiment indicators as it shares many similarities with them. That said, there are unique challenges and limitations associated with the index, which makes it necessary for traders to understand these distinctions in order to make better use of this tool. We will examine the comparison between fear & greed indexes and other indices closely by discussing their similarities and differences.

Similarities and Differences

The crypto fear and greed index, as well as traditional market sentiment indicators, have the same aim – to assess investors’ emotions in the markets. Classic indices rely on metrics such as alpha data analytics index whereas the fear and greed look into factors like Bitcoin dominance or social media mood.

Challenges and Limitations

At its core, the crypto fear and greed index is still a subjective assessment. This makes it vulnerable to manipulation through coordinated campaigns as well as bots which can easily distort the readings provided from such analysis techniques. Additionally, conditions within markets can change quickly and without warning, resulting in these factors not always being reliable about market sentiments.

In spite of these challenges associated with accurately measuring sentiments, the crypto fear and greed index still stands out in providing insight on investor sentiment around the trading of digital currencies.

Summary

Crypto traders can benefit greatly from the crypto fear and greed index which offers insight into market sentiment to help guide trading decisions. Knowing how to use this index in combination with other technical indicators enables traders to craft effective strategies for navigating the volatile crypto environment more effectively. Clarity on market conditions can improve overall decision making capabilities when it comes to cryptocurrency trading.

Frequently Asked Questions

What is the fear greed index for Bitcoin?

The Fear and Greed Index for Bitcoin is an indicator of market sentiment which measures the emotions of investors on a scale from 0 to 100. A score of 0 means extreme fear, while 100 stands for extreme greed.

This index can be a useful tool for traders who want to measure the emotions of other investors and make informed decisions about their investments.

What does the fear and greed index look into?

The Fear and Greed Index looks into investor sentiment by measuring seven different indicators, such as volatility, buy/sell volume, posts on social media, and Bitcoin dominance. These indicators are used to help investors and traders analyse the sentiment in the cryptocurrency market.