Key Points 📌

🤔 What is Tether? A stablecoin tied to traditional assets.

🛠️ How it Works: Tokenisation of fiat currencies like USD.

💰 Tokenomics: 1:1 peg with the US Dollar and other currencies.

📊 Why Choose Tether? Quick transfers, low fees, and stability.

⚠️ Potential Risks and Criticisms: Regulatory scrutiny and questions about reserves.

🚀 Getting Started: Buying, storing, and using Tether.

📚 FAQ: Quick answers to common questions.

Introduction 🌟

In the world of cryptocurrencies, Tether brings a sense of stability. This guide will break down what Tether is and why it’s essential in the crypto market.

What is Tether? 🌐

Tether is a stablecoin, designed to offer the benefits of digital currency without the volatility commonly associated with other cryptocurrencies like Bitcoin.

How it Works 🛠️

Tether achieves stability by pegging its value to traditional currencies like the US Dollar. It uses blockchain technology to tokenize these fiat currencies.

Tokenomics 💰

Tether maintains a 1:1 peg with the US Dollar. This means that for every Tether token (USDT) issued, there is an equivalent amount in reserves. The token can also be pegged to other currencies like the Euro.

Why Choose Tether? 📊

Stability is key:

🚀 Quick Transfers: Faster than traditional wire transfers.

💵 Low Fees: Smaller fees compared to other transfer methods.

📈 Market Stability: Acts as a safe harbour during market turbulence.

Potential Risks and Criticisms ⚠️

Tether is not without its risk:

🚨 Regulatory Scrutiny: The lack of transparency has drawn regulatory attention.

🤔 Reserve Questions: Concerns over whether reserves are fully backed.

Getting Started 🚀

To get into Tether, you’ll need to:

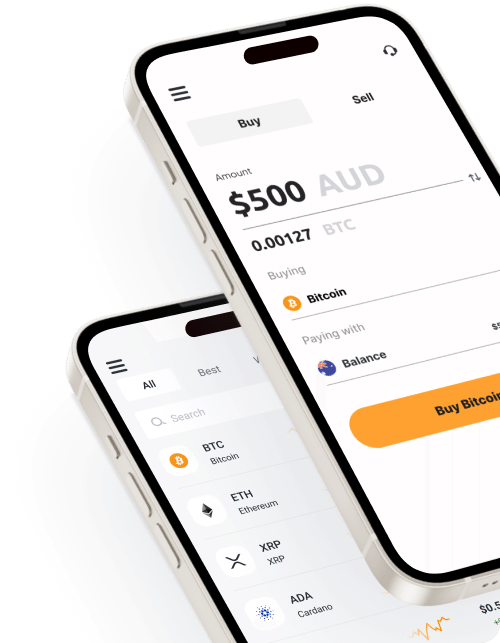

🛒 Buy USDT: You can buy USDT on Bitcoin.com.au.

🗄️ Store USDT: Hardware wallets like Ledger for long term storage, or browser based wallets like Metamask or Exodus for on the go transactions.

💸 Make Transfers: Use Tether for quick and cheap transfers.

FAQ 📚

🤔 What is Tether? A stablecoin pegged to the US Dollar.

🛒 How do I buy USDT? You can buy USDT on Bitcoin.com.au.

⚠️ Is Tether safe? There are some risks involved, particularly around regulatory scrutiny and reserve backing.

Conclusion 🎯

Tether offers a stable medium in a market known for its volatility. However, it’s important to be aware of its potential risks.

Further Reading 📚

Keen for more? There’s a wealth of info to explore: