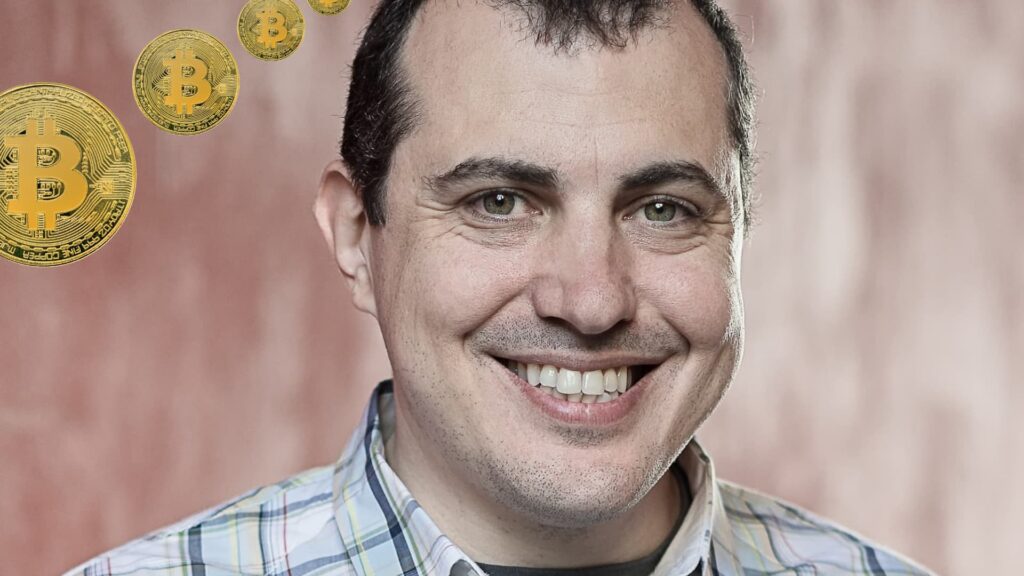

Andreas Antonopoulos, a leading expert on cryptocurrencies, gave a talk that some are calling ‘The State of the Crypto Industry’. Though only recently uploaded, the talk is actually a few years old. While some specific examples seem dated, much of the content is more pertinent now than ever.

The talk discusses why crypto, specifically Bitcoin, may become a global currency. It also discusses some of the barriers that it faces. He also forecasts how and where the world will adopt crypto in the future. Shockingly, he doesn’t think that America and Europe will adopt it first.

This has to do with the four fundamental requirements for massive conversion to crypto. According to Antonopoulos, those are relative utility, perceived safety, technology, and neutrality.

Relative utility

So why does Antonopoulos think that the areas where crypto is most popular will not adopt it first? That’s where relative utility comes in: because people in the ‘first world’ already have financial institutions that work well for them. Some people like the idea of crypto because it isn’t a government or a bank. However, banks and governments work fairly well in places like America and Europe. That’s not the case in places like much of Africa.

If you are living and breathing a first world structured, rule of law, easily negotiated contractual obligations, and resolutions through a justice system that actually works sometimes — but certainly better than most countries; a country where cross-border transactions are handled in a relatively efficient way, where you can move currency around and interact with the rest of the world… Bitcoin may not be that big a deal for you,

said Antonopoulos. If you live within a hundred miles of the border between Kenya and Tanzania, you regularly transact in four currencies – the Kenyan currency, then Tanzanian currency, the euro, and the U.S. dollar. You are used to carrying sacks of money. You are used to having floating exchange rates, governments that prey on your currency and dilute it. So, your expectations are very different.

Benefits of crypto are greater in these areas and problems that we usually associate with it are also smaller.

Do you think Bitcoin is volatile? Not even close. Most of Sub Saharan Africa would love to have the stability of Bitcoin,

Antonopoulos said. If you’re American and you ask ‘Is Bitcoin better than the dollar?’ 99% of people are going to say ‘no’. If you ask a Zimbabwean ‘Is Bitcoin better than the Zimbabwean dollar?’ — goat poo is better than the Zimbabwean dollar.

Safety

Much of the world already meets the first fundamental requirement of relative utility. The case is not the same for the second requirement, safety. This has to do with the way that some world governments police currency.

We don’t think about that,

says Antonopoulos. There are plenty of places in the world where if you [have a currency other than the national currency] you are a smuggler, and there is no due process. So you get shot for holding Bitcoin.

Fortunately, there’s something that you can do about this no matter where you are in the world. You can support Bitcoin charities and aid programs.

When a legislator runs out with the campaign that says ‘If you kill Bitcoin, these kids starve, this puppy goes to a kill shelter, and this bear in China doesn’t have a future and goes extinct.’, that’s a much better message than ‘Bob, the speculator, won’t make enough money.’,

said Antonopoulos. Invest in [Bitcoin-based] charities because that enhances the concept of neutrality and makes it concrete.

Technology

The third fundamental requirement, technology, is also an obstacle to much of the world. The places that Antonopoulos says would most benefit from crypto are those that seldom, if ever, have internet and electricity. Right now, those things seem essential to crypto, though some services and apps have been addressing those concerns.

We need to make Bitcoin usable without constant access to the blockchain. This is already possible in a number of ways. You can do ‘islands of Bitcoin’ that enable transactional Bitcoin within that island and occasionally syncs back only the inflows and outflows into the blockchain,

said Antonopoulos. Can we use Bitcoin in a non-electricity environment, even without cell phones? Yes, we can. […] You can actually build a full paper system of currency that is backed not by gold, not by floating exchange rates, but actually backed by proof of stake in Bitcoin and enables you to trade these bits of paper at a premium of face value.

Neutrality

That brings us to the fourth fundamental principle, neutrality. Most people will think of neutrality in terms of how governments control crypto. However, Antonopoulos points out that neutrality can mean many things. For example, the Quran prohibits Muslims from engaging in interest. Similarly, orthodox Jews cannot use electricity on the Sabbath.

Neutrality in Bitcoin means being able to adopt Bitcoin in any culture, in any language, any religion, any geography, but also in any political or economic system,

Antonopoulos says. Neutrality in Bitcoin means being able to address the rest of the world because, at the end of the day, it’s not about [the first world’], it’s about the other six billion.

Antonopoulos compared the neutrality of crypto, still in its infancy, with attacks on the neutrality of the much older internet.

We started out with a completely neutral IP protocol that allowed us to have that equality of voice across any channel. […] And then the internet got popular and the first thing that people started attacking was the concept of neutrality because if you’re at the top of the ladder the first thing you do is pull the ladder up behind you,

said Antonopoulos. Neutrality as a principle is built into Bitcoin today but it will only survive if it is vigorously defended. And there will be plenty of opportunities to defend it because it will be attacked.

Fortunately, we’ve seen attacks on internet neutrality and know how to respond.

If you see people trying to make sure that transactions in Bitcoin can be prioritised in a way, not per the size of the transaction but based on who the sender is or who the recipient is, scream,

said the crypto expert.

Predictions for global adoption

Antonopoulos has provided the conditions for global adoption of crypto. He has explained ways in which we can foster those conditions. His talk also gave a prediction for how it will come about.

We assume that Bitcoin is going to gradually get broader and broader and broader over time until eventually it’s toppled various currencies and becomes the world currency. That’s not how it’s going to happen,

he says. Instead, what you’re going to see is a crisis, perhaps something like Cyprus, and you’re going to see a massive conversion in a very limited geography.

Massive adoption in one region will make it easier and more likely for adoption to occur in other regions. Of course, adoption will pose its own challenges.

It’s not about whether Bitcoin will be adopted, or where it will be adopted, or when it will be adopted,

Antonopoulos concluded. The only question is will we be ready, as the Bitcoin community, for the influx of billions of people? For the use of Bitcoin in new scenarios at completely different transactional rates.