Have you ever thought about how many Bitcoins exist? In this article, we’ll take a look at how many Bitcoins are currently available, how the amount of Bitcoin increases over time and the implications for both miners and investors.

Short Summary

- 19.4 million Bitcoins already exist, with the remaining 8% to be released over time at a decreasing rate due to the halving process.

- Lost and inaccessible wallets have caused a decrease in available supply, making existing Bitcoins more valuable.

- Institutional investors view Bitcoin as digital gold due to its limited supply and potential for price appreciation.

Contents

- Current Bitcoin Supply: A Snapshot

- Factors Affecting Bitcoin Supply

- Bitcoin Mining Landscape

- Implications for Bitcoin Investors

- Beyond the 21 Million Cap: The Role of Transaction Fees

- Summary

- Frequently Asked Questions

Current Bitcoin Supply: A Snapshot

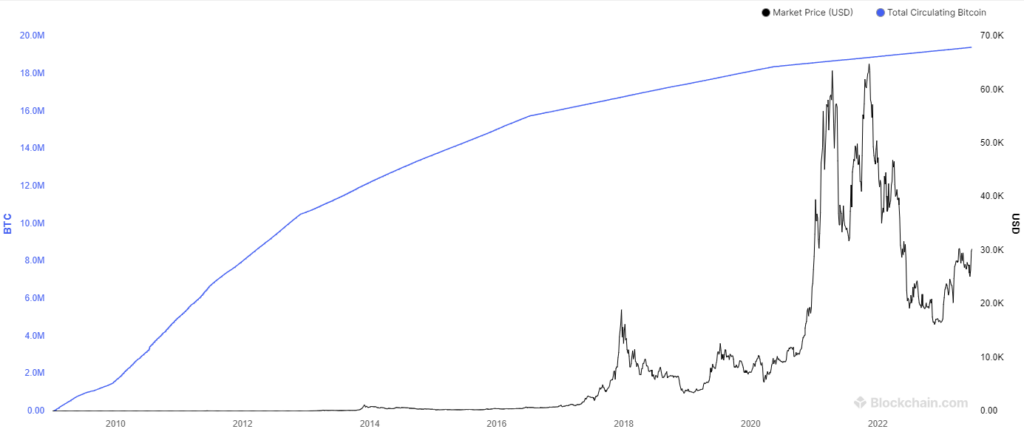

At present, 19.4 million Bitcoins have already been mined and there are roughly 1.6 million left to go until reaching the total cap of 21 million Bitcoins. Once this ceiling is met, no new coins will be generated. The limited supply plays a major role in influencing Bitcoin’s value.

Percentage of Total Supply Mined

With approximately 92% of the Bitcoin supply now mined, these Bitcoins are held by miners, everyday users and investors alike. The remaining 8%, will be released gradually through mining rewards and will continue to be released at a decreasing rate due to the ‘Bitcoin halving’ process.

Factors Affecting Bitcoin Supply

The Bitcoin halving process is an essential event that influences its supply. Every four years, the amount of Bitcoin that enters circulation through mining rewards is halved. In addition to this however, there are unclaimed and locked away wallets that hold large amounts of Bitcoin which in turn also decrease the total supply.

Lost Bitcoins

The total Bitcoin supply is limited due to a considerable number of Bitcoins being irretrievably lost from forgotten passwords, hardware failures and other factors. Around 20% of the world’s circulating Bitcoins are estimated to be out-of-reach.

Bitcoin Mining Landscape

The mining landscape of Bitcoin is constantly changing, primarily due to the fluctuations in block rewards and difficulty adjustments. These dynamics have a significant impact on miners’ profitability as well as the security of the Bitcoin network. As more Bitcoins are mined, the rewards decrease over time.

Mining Difficulty and Adjustments

The Bitcoin mining difficulty is designed to adjust and keep a stable inflow of producing new Bitcoins based on the total computing power across its network. This means that regardless of how much fluctuation there might be in hash rates, miners are still given being rewarded for verifying transactions and securing the blockchain.

Block Rewards and Their Impact on Miners

The Bitcoin blockchain is sustained by block rewards and transaction fees, which are essential to miners’ profitability. Bitcoin halving events can lead to a decrease in mining rewards but an increase in the digital currency’s value. Hence, Bitcoin miners must tweak their business strategies to maintain profitability when their earnings from these rewards drop. Eventually, what miners earn will largely come from transaction fees instead of just Bitcoin block rewards. This shift could bring about major changes not just in the whole Bitcoin network, but also in the companies that keep it running.

Implications for Bitcoin Investors

Bitcoin is often compared to digital gold and its limited supply means that it isn’t vulnerable to the inflationary pressure of traditional fiat currencies. Many investors view Bitcoin as a store of value, providing them with an effective hedge against increasing prices (inflation) due to traditional currency devaluation. This has made it an attractive option for those looking to safeguard their wealth over time. The capped total number of coins gives added potential for price appreciation, which makes Bitcoin particularly interesting as an investment asset today.

Bitcoin as Digital Gold

Due to its limited supply and fixed amount, Bitcoin is often compared to gold as a safe haven. Unlike central banks or governments who control physical currency, this digital resource cannot be altered making it a valuable asset seen by institutional investors as a hedge against inflation.

Beyond the 21 Million Cap: The Role of Transaction Fees

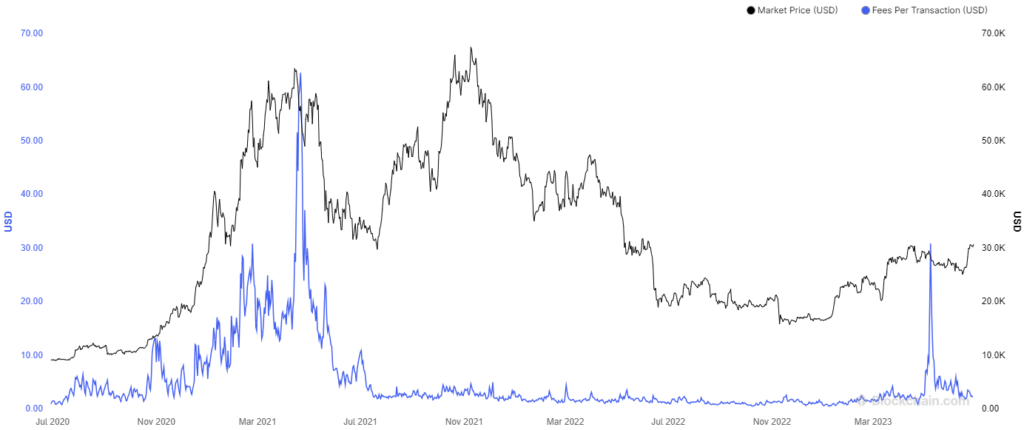

As Bitcoin approaches its 21 million cap, transaction fees will become increasingly important in the system. Since block rewards are diminishing, miners must discover other means of income so that they can continue verifying transactions and providing security for the network. Transaction fees paid by users to miners motivate them to prioritise those with higher payments for faster transaction times. As these block rewards decrease over time due to a limited supply, it is even more important that alternative incentive tools are developed in the Bitcoin ecosystem.

Current State of Transaction Fees

Transaction fees, although currently a small portion of miners’ revenue, are expected to play an increased role as block rewards decrease. The cost for Bitcoin transactions can vary wildly from being mere cents up to over $20 depending on the amount of congestion in the network and how quickly a user of the network wants their transaction be processed.

As supply dwindles for new Bitcoins, it is likely that these fee costs will become more substantial sources of income for miners instead.

Summary

In summary, Bitcoin’s supply of 21 million coins significantly impact, investors, traders and miners alike. Its potential for price appreciation (similar to a digital gold asset class) along with the growing impact of transaction fees due to the havening events are key components in the Bitcoin ecosystem. It is essential to remain informed about these factors and their implications, so investors can benefit from what opportunities Bitcoin presents.

Frequently Asked Questions

Why can only 21 million Bitcoin exist?

Satoshi Nakamoto the creator of Bitcoin purposefully set a limited amount of this digital currency to be produced when it was first established. That total is 21 million. This serves to make sure there will always be demand for these units and adds scarcity value to them.

What happens when 21 million Bitcoins are mined?

Around the year 2140 is when all 21 million Bitcoins will be mined, bringing an end to new Bitcoin creation. From that point onward, miners’ revenue streams from block rewards will halt and they must instead depend on transaction fees and other revenue sources for income.

Who owns the most Bitcoin?

Satoshi Nakamoto, the anonymous inventor of Bitcoin, is believed to have the most substantial quantity of BTC. It’s estimated he has 1 million coins with a total value of $27.13 billion. This makes him number one on the list when it comes to cryptocurrency whales by holdings.

How long does it take to mine 1 Bitcoin?

The process of Bitcoin mining takes around 10 minutes for a single Bitcoin. It requires specific software and hardware, but this can be shared amongst many multiple miners, making it more accessible to everyone who wants to participate.

Currently each new block produced is awarded with 6.25 Bitcoins as a reward.

How many Bitcoins are there?

There are a whopping 19,410,450 Bitcoins in circulation as of writing this article.